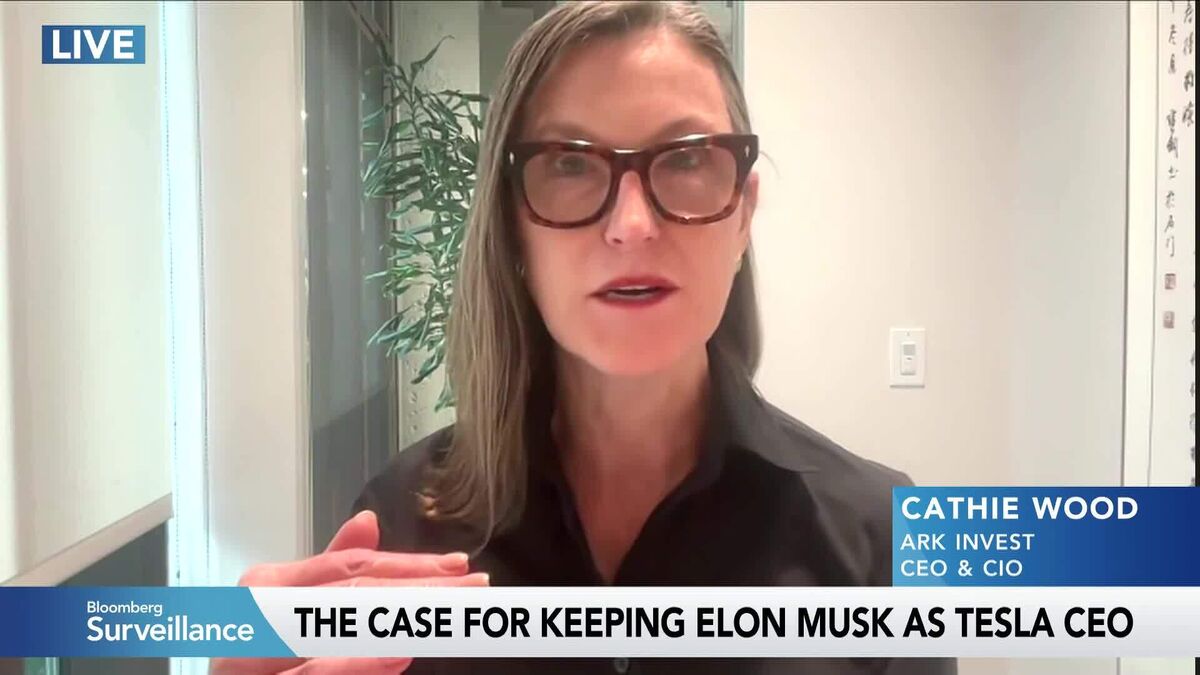

Tesla shareholders to vote on Musk’s $1tn pay deal

NeutralFinancial Markets

Tesla shareholders to vote on Musk’s $1tn pay deal

Tesla shareholders are set to vote on a historic $1 trillion pay package for CEO Elon Musk, who has indicated he may resign if the proposal does not receive their support. This vote is significant as it reflects the confidence investors have in Musk's leadership and the company's future, potentially impacting Tesla's stock performance and strategic direction.

— via World Pulse Now AI Editorial System