Japan Stocks Look Lower, Sentiment Lifts Elsewhere: Markets Wrap

NeutralFinancial Markets

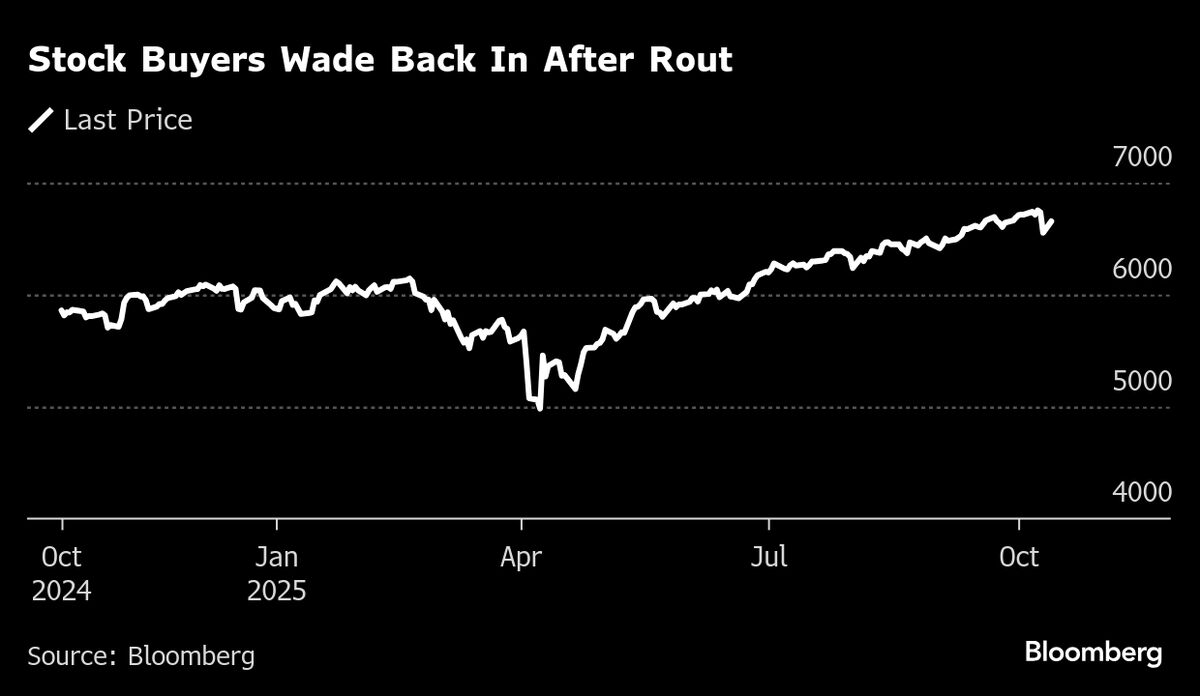

Japanese stocks are expected to decline when trading resumes after a three-day weekend, reflecting a cautious outlook. However, there's a silver lining as optimism surrounding US-China trade negotiations is boosting sentiment in global equity markets. This contrast highlights the interconnectedness of global markets and how developments in one region can influence investor confidence elsewhere.

— Curated by the World Pulse Now AI Editorial System