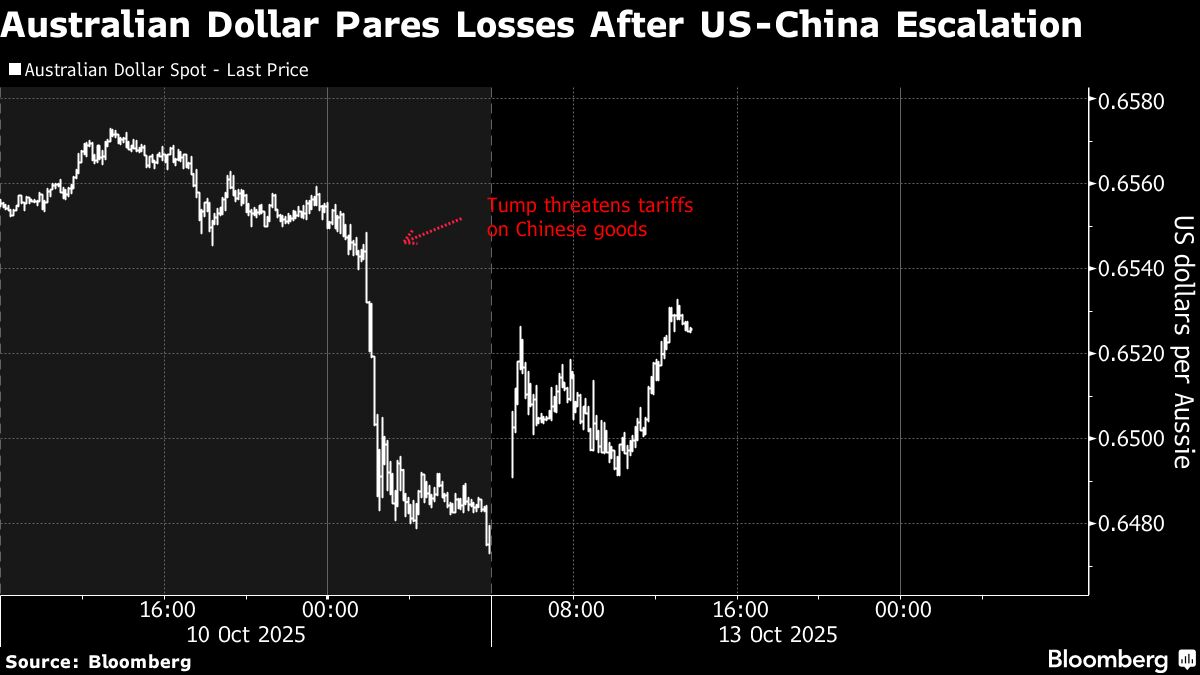

Aussie Risks Losing Ground Versus Yen as Trade, Japan Risks Loom

NegativeFinancial Markets

The Australian dollar is facing challenges against the yen due to rising US-China trade tensions and political instability in Japan. This situation is significant as it could impact trade relations and economic stability in the region, making it crucial for investors and businesses to stay informed about currency fluctuations.

— Curated by the World Pulse Now AI Editorial System