Morning Bid: AI fizzes and banks are buoyant

PositiveFinancial Markets

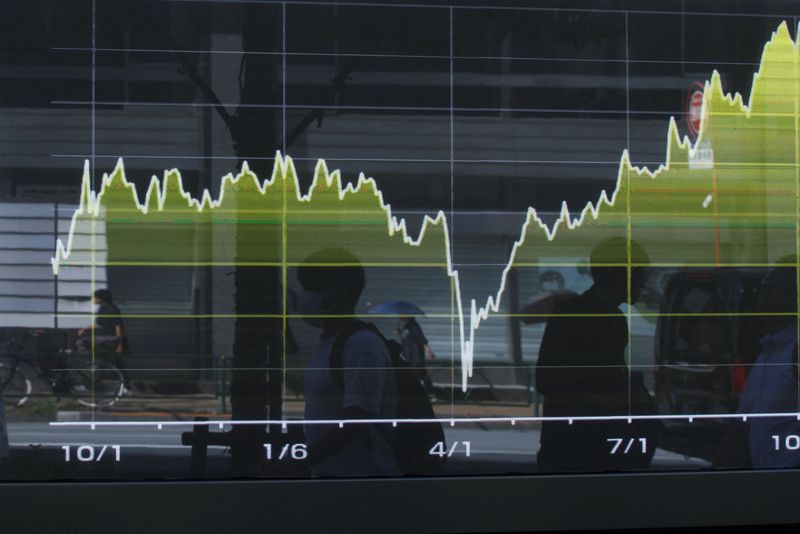

In today's financial news, the buzz around artificial intelligence continues to grow, with investors showing increased confidence in tech stocks. Banks are also experiencing a buoyant phase, reflecting a positive outlook in the market. This matters because the rise of AI could lead to significant advancements in various sectors, while the stability of banks indicates a healthy economy, encouraging more investments and innovation.

— Curated by the World Pulse Now AI Editorial System