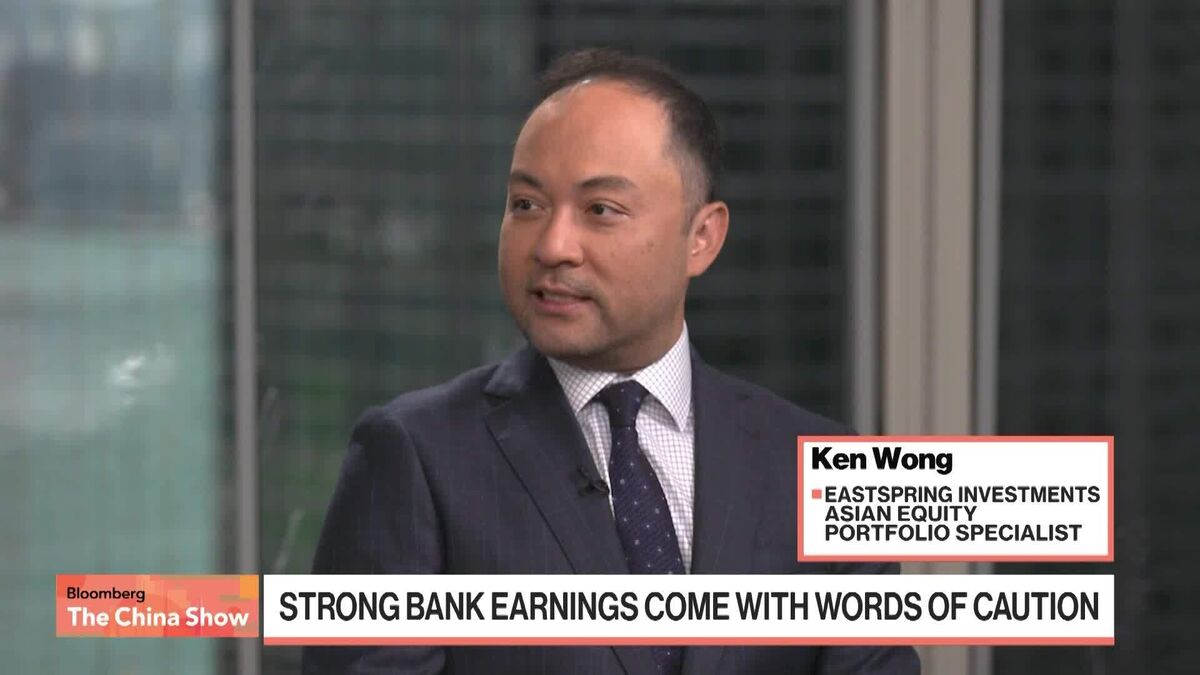

US Earnings Guidance for 2026 Is Important Theme, Eastspring Investments' Wong Says

NeutralFinancial Markets

Ken Wong from Eastspring Investments highlights the significance of US earnings guidance for 2026 during his appearance on Bloomberg Television. This topic is crucial as it can influence investment strategies and market expectations, making it essential for investors to stay informed about future earnings projections.

— Curated by the World Pulse Now AI Editorial System