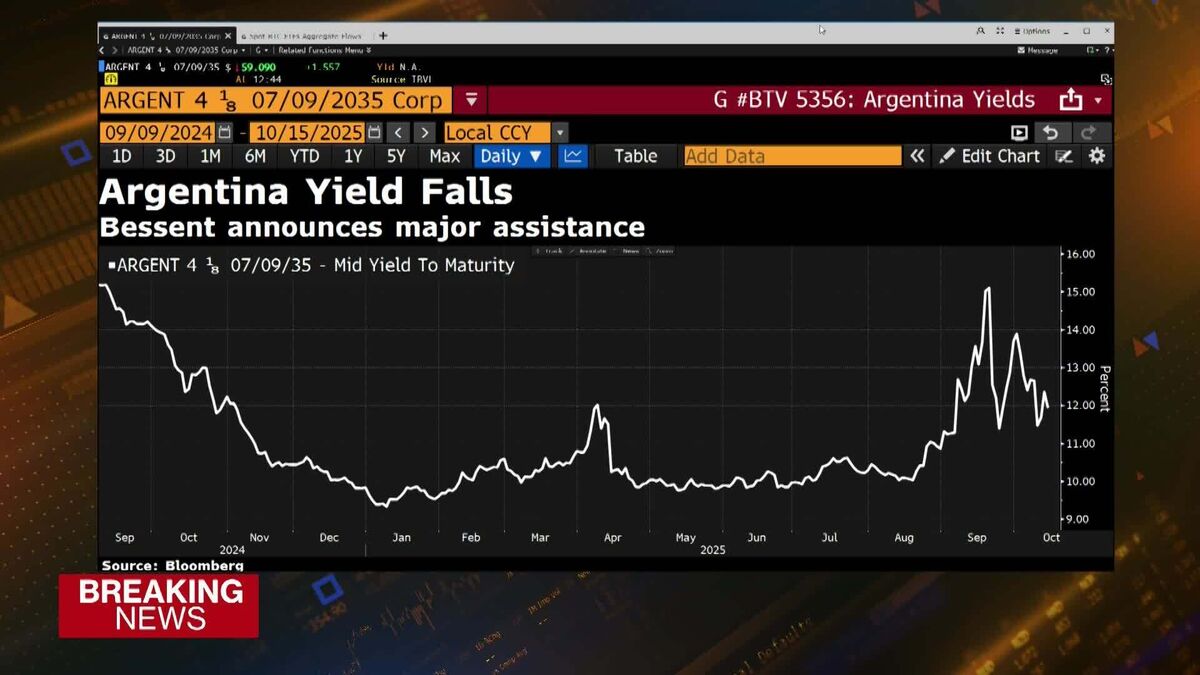

US Rescue of Argentina Is 'Unconventional,' Summers Says

PositiveFinancial Markets

Former Treasury Secretary Lawrence Summers has described the Trump administration's rescue plan for Argentina as 'unconventional,' emphasizing the importance of U.S. leadership in supporting countries facing financial crises. He believes that the U.S. should play a pivotal role in ensuring global financial stability, especially during times of sudden liquidity loss. This perspective highlights the significance of international cooperation in addressing economic challenges, making it a crucial topic for both policymakers and investors.

— Curated by the World Pulse Now AI Editorial System