Ringkjøbing Landbobank buys back shares worth DKK 28.3 million in week 39

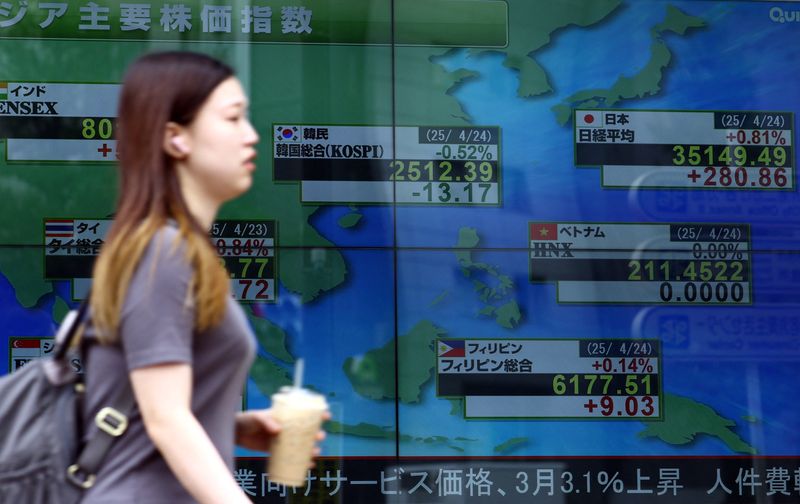

PositiveFinancial Markets

Ringkjøbing Landbobank has made a significant move by buying back shares worth DKK 28.3 million in week 39. This buyback not only reflects the bank's strong financial position but also signals confidence in its future growth. Such actions can enhance shareholder value and indicate a commitment to returning capital to investors, which is always a positive sign in the financial markets.

— Curated by the World Pulse Now AI Editorial System