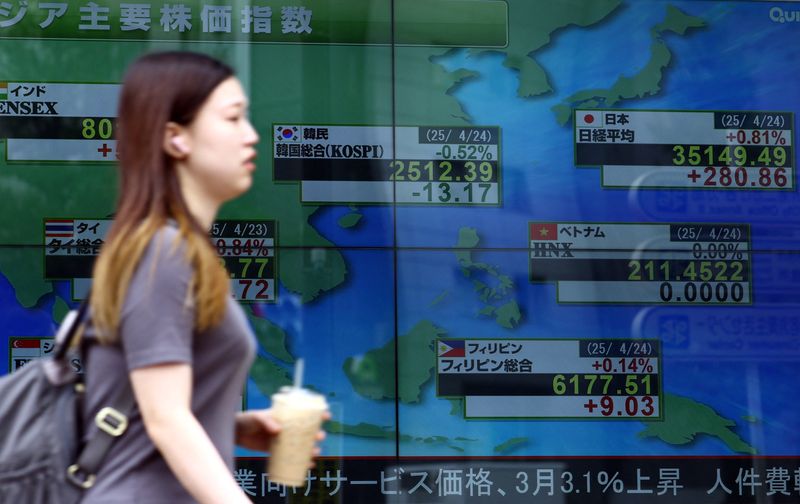

Shares edge higher in Asia, dollar dips as US government risks shutdown

NeutralFinancial Markets

In Asia, shares have shown a slight increase as investors react to the potential risks of a US government shutdown, which has also led to a dip in the dollar's value. This situation is significant as it reflects the ongoing uncertainties in the global economy and how political decisions in the US can impact markets worldwide.

— Curated by the World Pulse Now AI Editorial System