France's Macron pushes for more investment, trade rebalancing in China visit

PositiveFinancial Markets

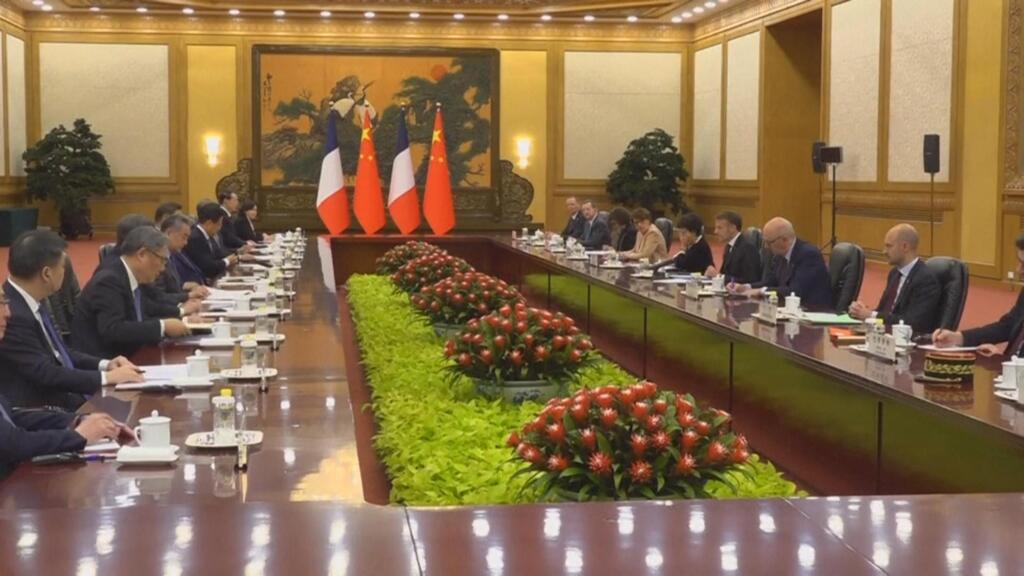

- French President Emmanuel Macron is on a visit to China accompanied by business leaders, aiming to attract increased Chinese investment in France and address the trade deficit between the two nations. This visit includes discussions with Chinese President Xi Jinping and the signing of multiple cooperation agreements.

- The significance of this visit lies in Macron's efforts to strengthen economic ties with China, which is crucial for France's economic strategy and could potentially lead to enhanced bilateral relations and investment opportunities in various sectors.

- This development occurs against a backdrop of global trade tensions and shifting alliances, with Macron emphasizing the need for multilateralism to prevent the disintegration of the world order, reflecting broader concerns about international cooperation amid rising nationalism.

— via World Pulse Now AI Editorial System