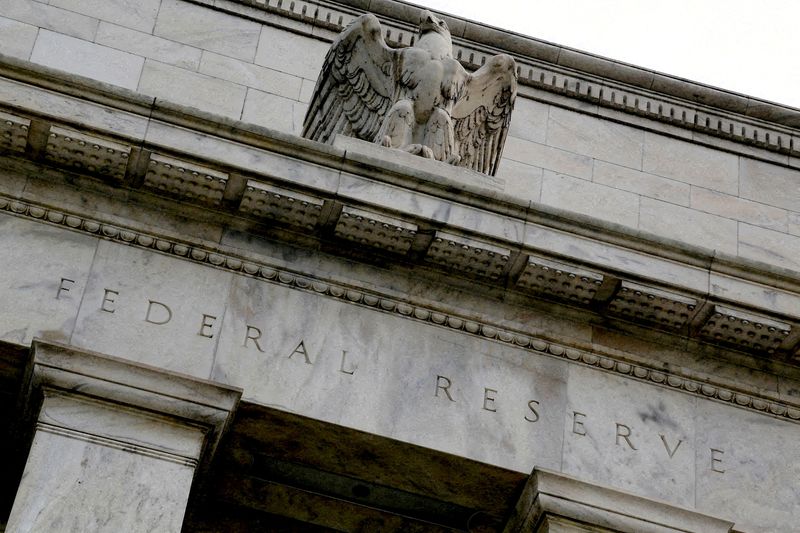

US consumers are feeling the stress of inflation, interest rates, report shows

NegativeFinancial Markets

A recent report highlights that US consumers are increasingly stressed due to rising inflation and interest rates. This financial pressure is affecting their spending habits and overall economic confidence.

Editor’s Note: Understanding consumer sentiment is crucial as it directly impacts economic growth. If consumers feel financially strained, they may cut back on spending, which can slow down the economy. This report sheds light on the challenges many are facing.

— Curated by the World Pulse Now AI Editorial System