Fed ‘Third Mandate’ Forces Bond Traders to Rethink Age-Old Rules

NeutralFinancial Markets

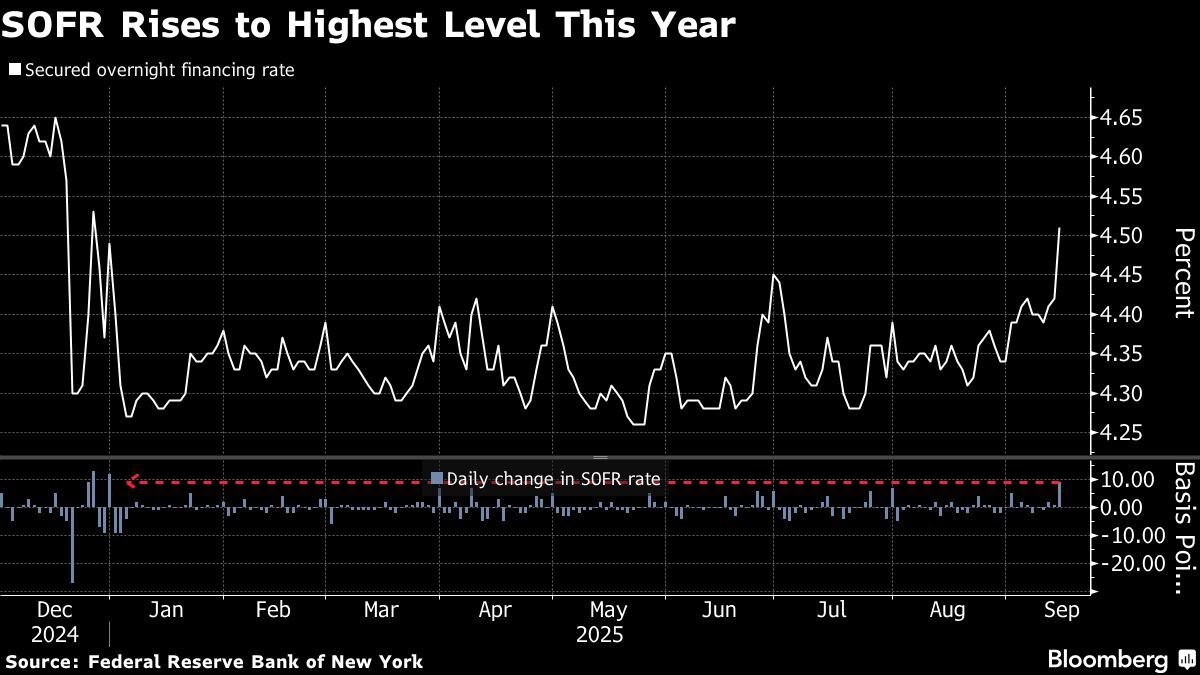

The Federal Reserve's dual mandate of price stability and maximum employment has long influenced interest rate decisions. Recent discussions suggest a potential 'third mandate' that could change how bond traders operate.

Editor’s Note: This shift in the Federal Reserve's approach could have significant implications for financial markets and economic policy. Understanding these changes is crucial for investors and policymakers alike.

— Curated by the World Pulse Now AI Editorial System