Jobs Surveys Show ‘Concerning Weakness’ in Labor, Says Pimco Economist Wilding

NegativeFinancial Markets

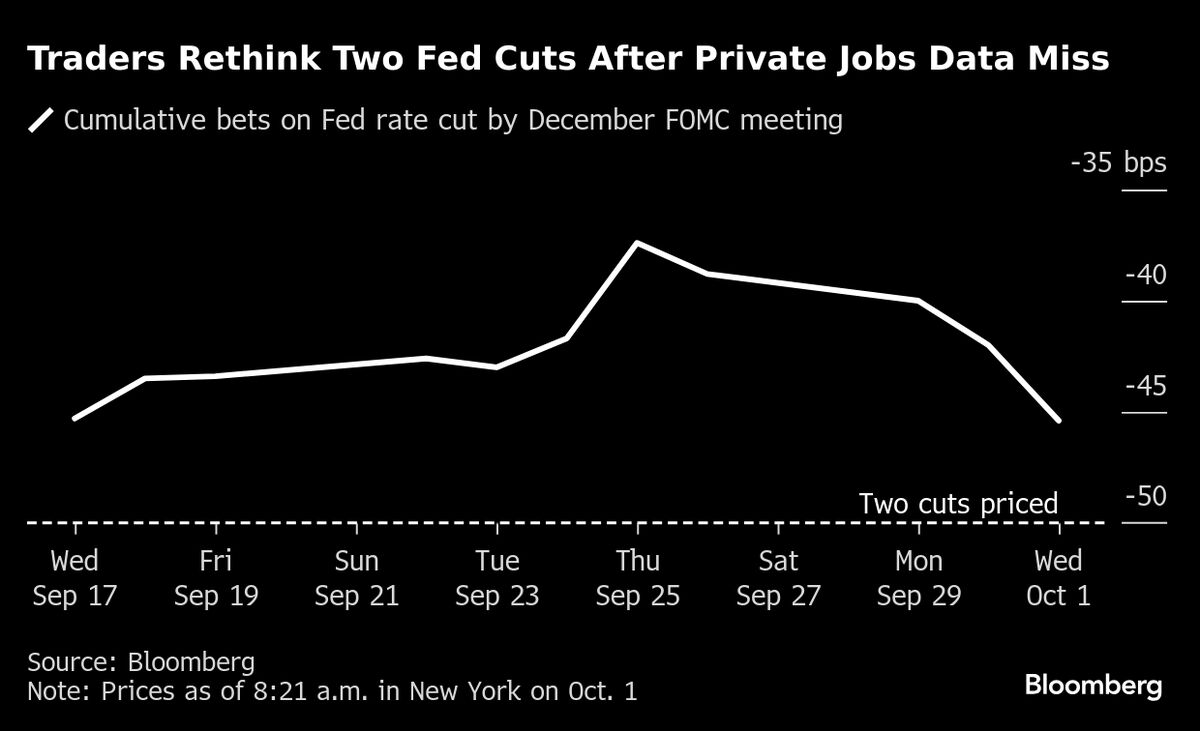

Tiffany Wilding, an economist at Pimco, has raised alarms about the recent decline in the US labor market, noting a drop of 32,000 jobs according to the latest ADP report. This concerning trend could have significant implications for the Federal Reserve's decisions on interest rate cuts. As the labor market weakens, it raises questions about economic stability and the potential for further monetary policy adjustments, making it a critical issue for both policymakers and the public.

— Curated by the World Pulse Now AI Editorial System