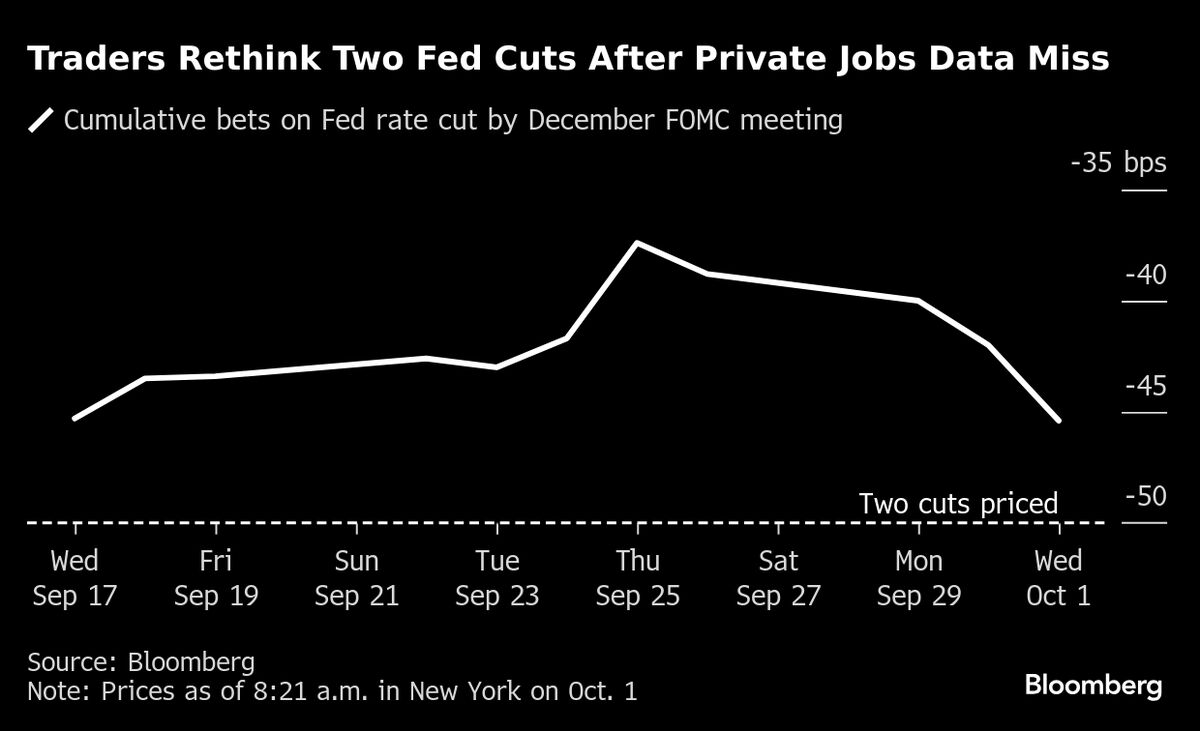

Yet another recession indicator is flashing as consumer confidence declines sharply in September

NegativeFinancial Markets

Consumer confidence has taken a significant hit in September, falling below crucial levels that could pose challenges for Federal Reserve policymakers and the optimistic outlook on Wall Street. This decline is concerning as it may signal a potential recession, affecting spending and investment decisions across the economy.

— Curated by the World Pulse Now AI Editorial System