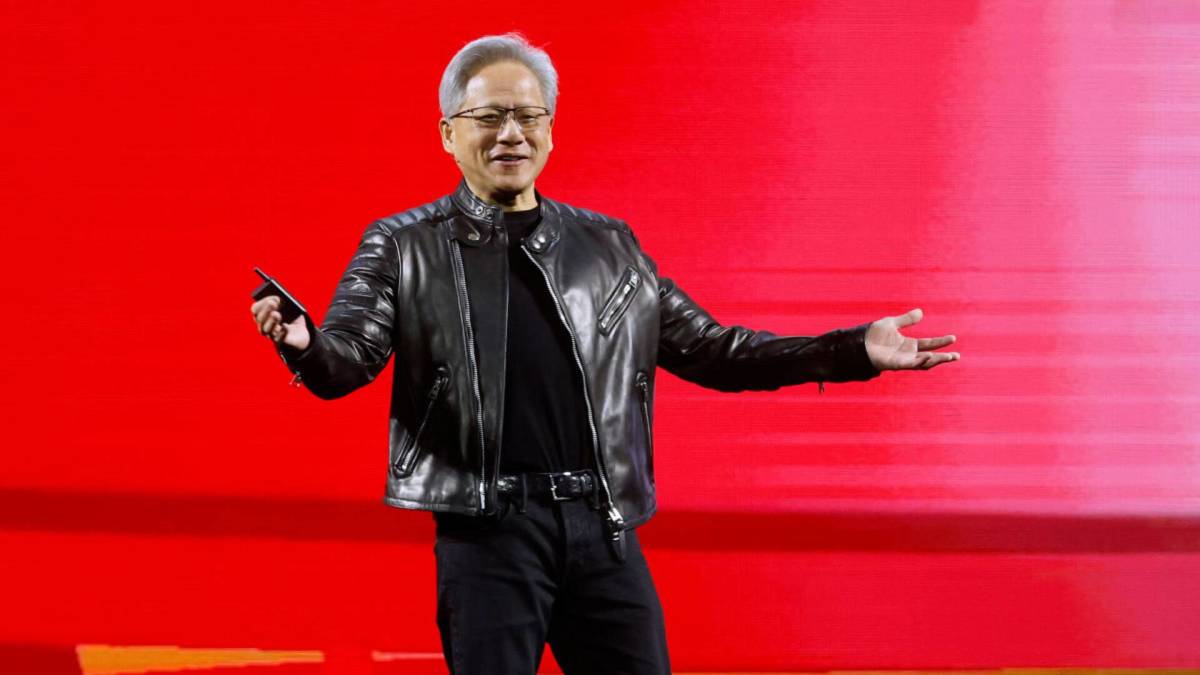

Analysts shift bets on which stocks will be the next big winners

NeutralFinancial Markets

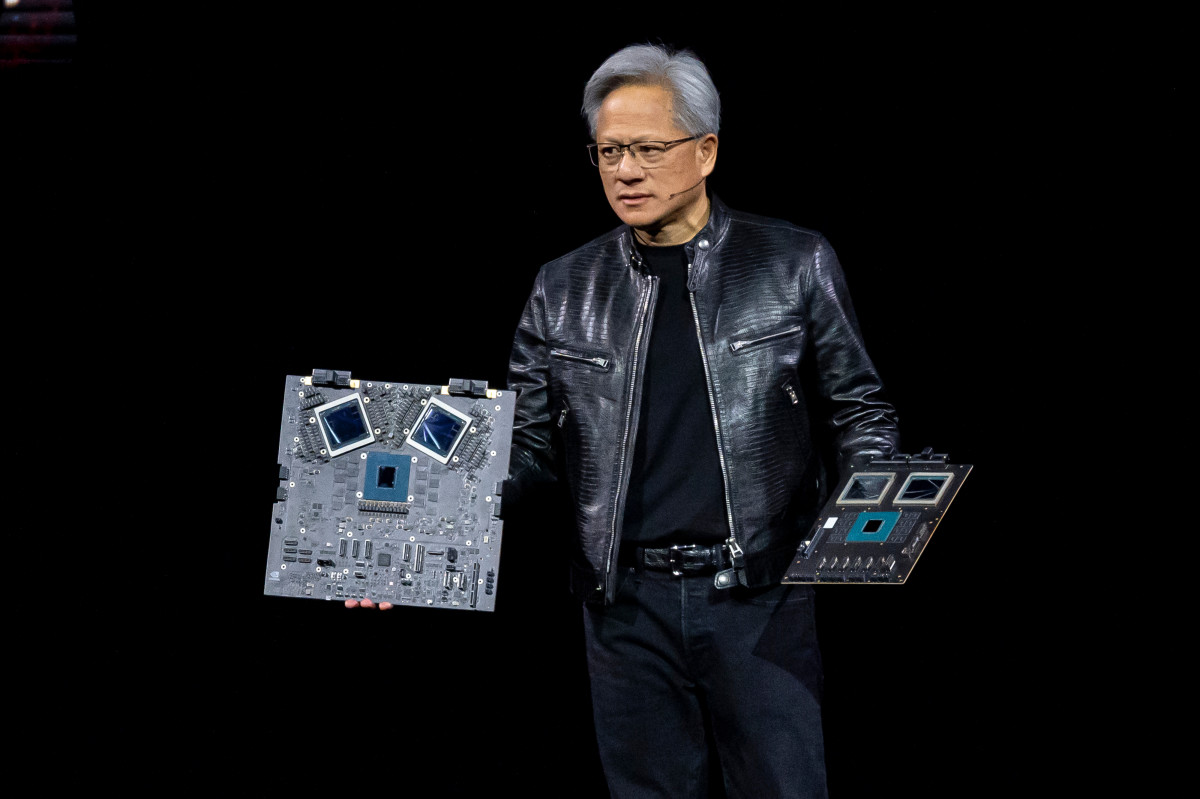

Analysts are reevaluating their predictions on which stocks might emerge as the next big winners, particularly in the tech sector. Bank of America has raised concerns that the high capital intensity of technology companies could negatively impact returns if investments in artificial intelligence do not yield results in the near future. This shift in perspective is significant as it highlights the cautious approach investors are taking amidst the evolving landscape of tech investments.

— Curated by the World Pulse Now AI Editorial System