SpaceX Starts a Wall Street Bake-Off to Hire Banks for Possible IPO

NeutralFinancial Markets

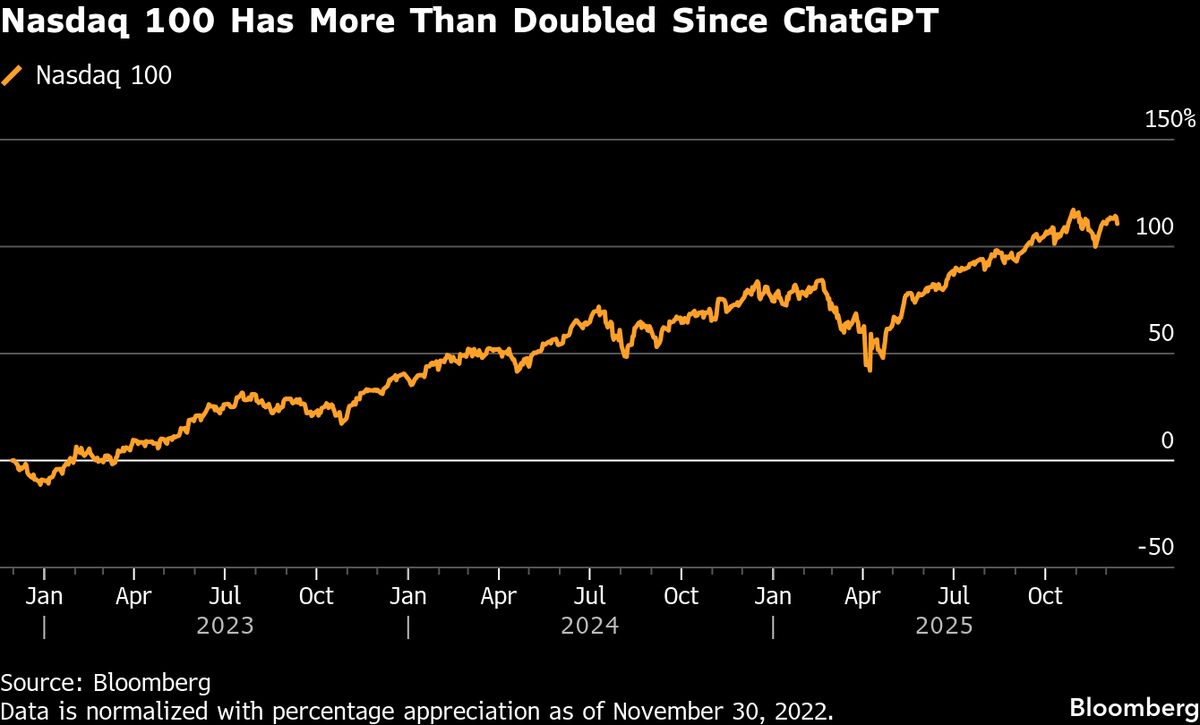

- SpaceX has initiated a process to interview banks on Wall Street for potential advisory roles regarding its initial public offering (IPO), signaling a significant step towards becoming a publicly traded company. This move comes as the company prepares for an IPO that could occur in 2026, with expectations to raise significantly more than $30 billion.

- The decision to engage Wall Street banks is crucial for SpaceX as it seeks to navigate the complexities of going public, which could enhance its financial capabilities and market presence. A successful IPO could provide the necessary capital for further expansion and innovation in the aerospace sector.

- This development reflects a broader trend in the market where private companies are increasingly considering IPOs as a means to access capital and grow. SpaceX's anticipated valuation of up to $1.5 trillion positions it as a potential leader in the IPO landscape, which could unlock substantial value in the private sector and reshape investor interest in the commercial space industry.

— via World Pulse Now AI Editorial System