Wall Street Traders on Hold in Run-Up to Jobs Data: Markets Wrap

NeutralFinancial Markets

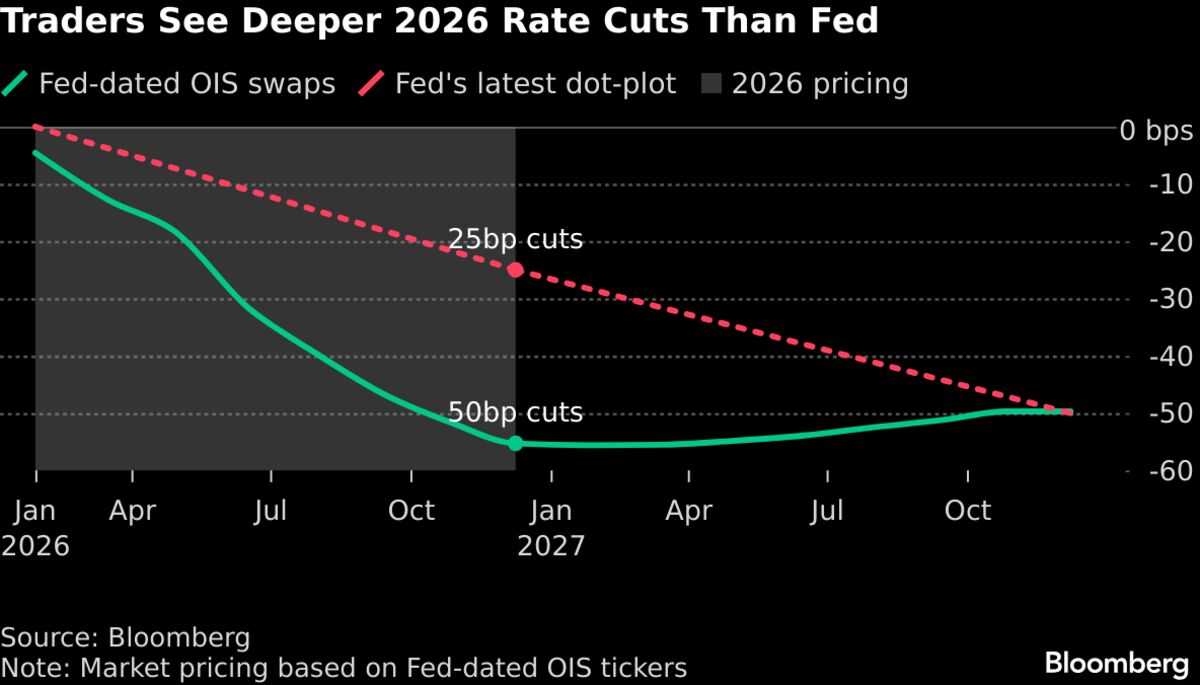

- The last full trading week of 2025 commenced with Wall Street traders adopting a cautious stance as they awaited crucial economic data that could influence the Federal Reserve's interest rate decisions. Stocks, bonds, and the dollar exhibited volatility amid this uncertainty.

- This development is significant as it reflects traders' hesitance to make substantial investments ahead of key jobs data, which is expected to provide insights into the health of the U.S. economy and the Fed's monetary policy direction.

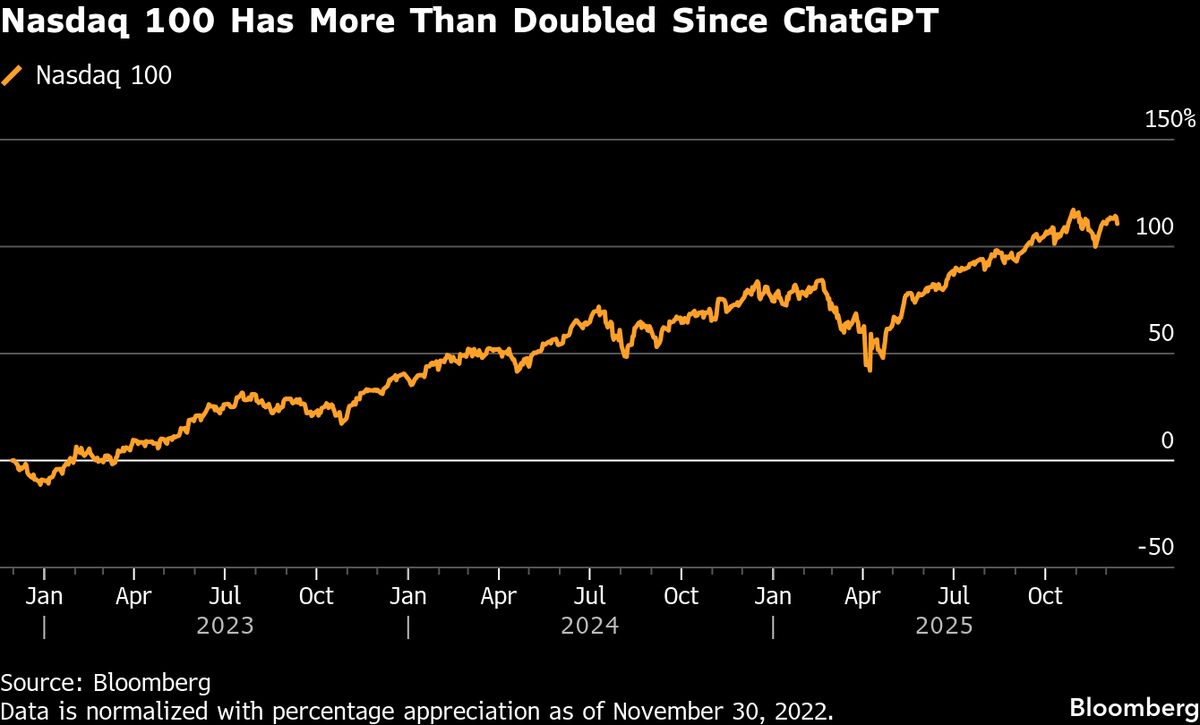

- The broader market sentiment is marked by concerns over a potential tech bubble, particularly in AI-related stocks, alongside inflation worries, which have contributed to recent declines in global markets, including Wall Street.

— via World Pulse Now AI Editorial System