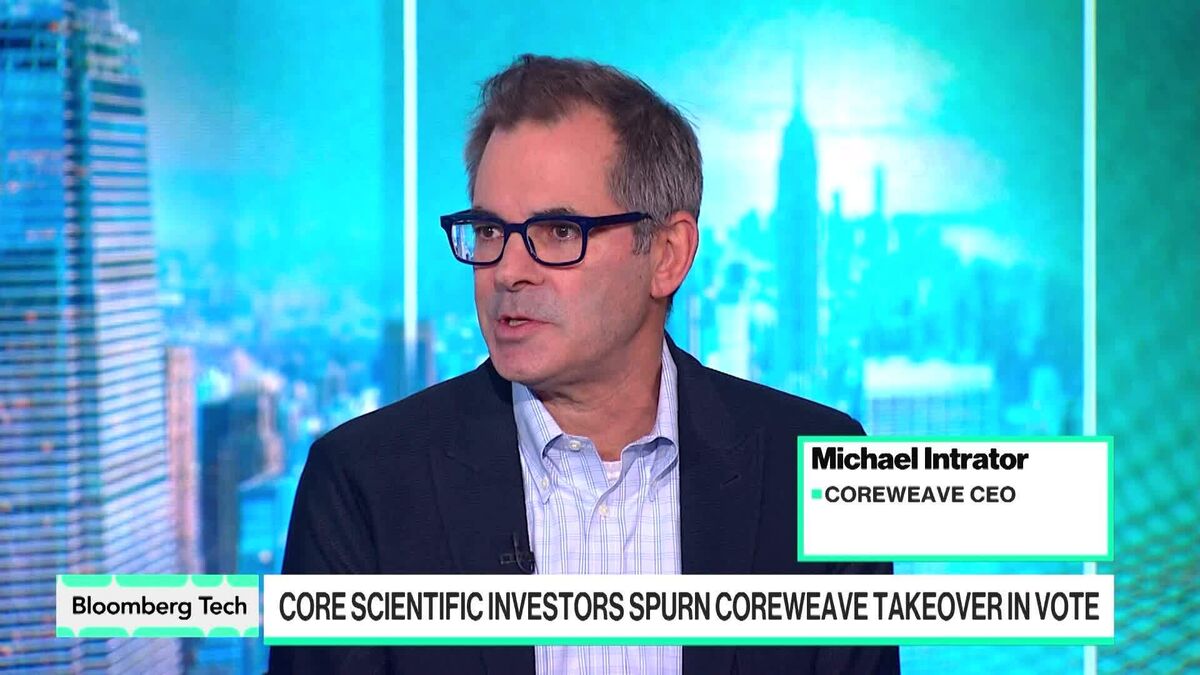

CoreWeave Deal Spree Goes on After Core Scientific Snub

NeutralFinancial Markets

CoreWeave continues to pursue deals even after Core Scientific shareholders turned down its acquisition offer. Despite this setback, CoreWeave's CEO, Michael Intrator, emphasizes that the relationship between the two companies remains strong. This situation highlights the complexities of corporate relationships and the ongoing strategies companies employ to navigate challenges in the tech industry.

— Curated by the World Pulse Now AI Editorial System