Cathie Wood's ARK ETF adjusts portfolio, adds Alibaba and Baidu stock

PositiveFinancial Markets

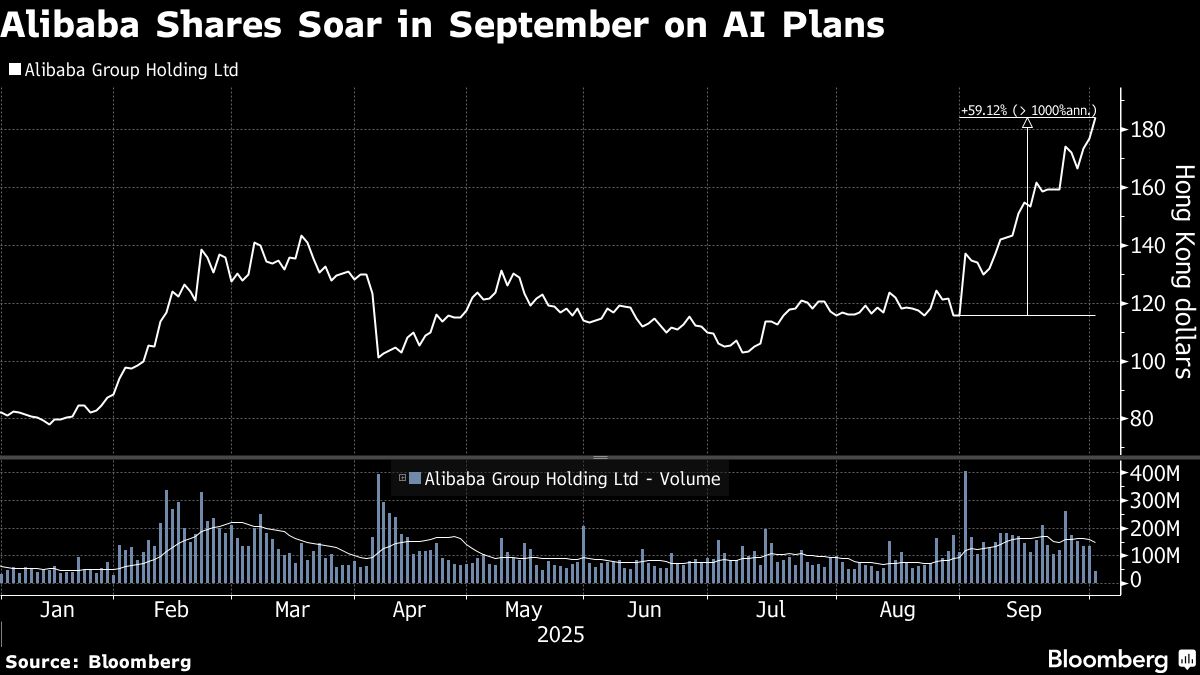

Cathie Wood's ARK ETF has made notable adjustments to its portfolio by adding shares of Alibaba and Baidu. This move reflects a strategic shift towards companies that are poised for growth in the tech sector, particularly in China. Investors are keenly watching these changes as they could signal a positive outlook for the ETF's performance, especially given the increasing interest in technology stocks.

— Curated by the World Pulse Now AI Editorial System