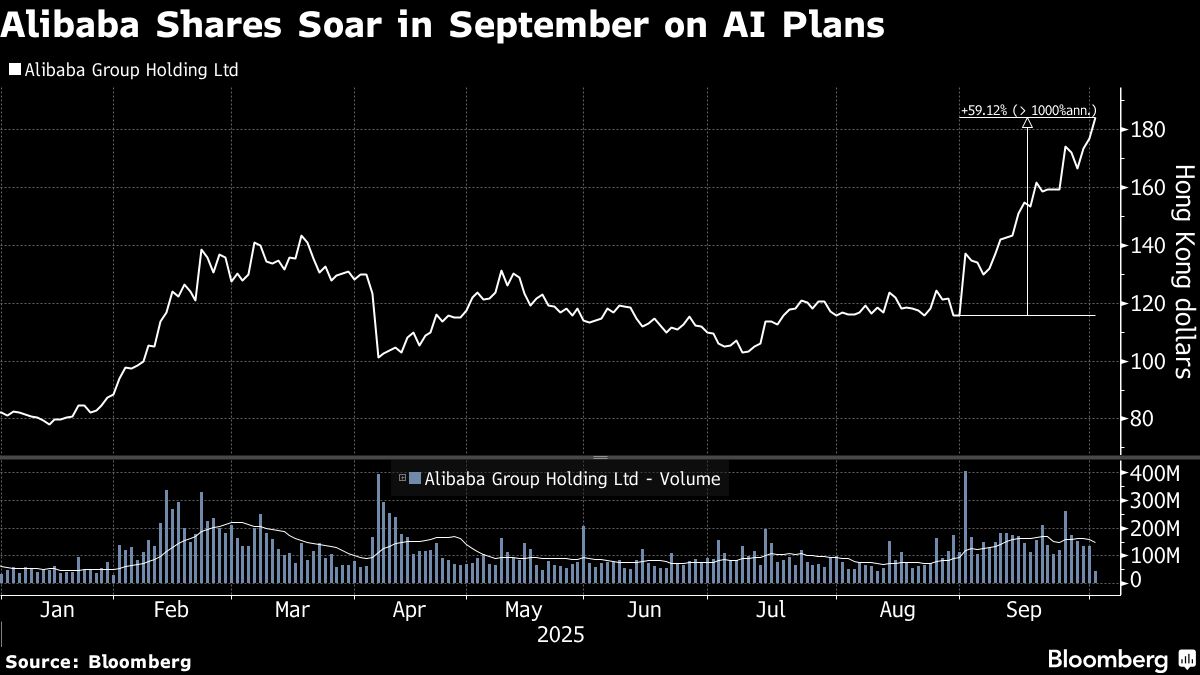

JPMorgan raises Alibaba stock price target to HK$240 on cloud growth

PositiveFinancial Markets

JPMorgan has raised its price target for Alibaba's stock to HK$240, citing strong growth in the company's cloud services. This adjustment reflects confidence in Alibaba's ability to expand its market share in the competitive cloud sector, which is crucial for its overall growth strategy. Investors may view this as a positive sign for Alibaba's future performance, especially as the demand for cloud solutions continues to rise.

— Curated by the World Pulse Now AI Editorial System