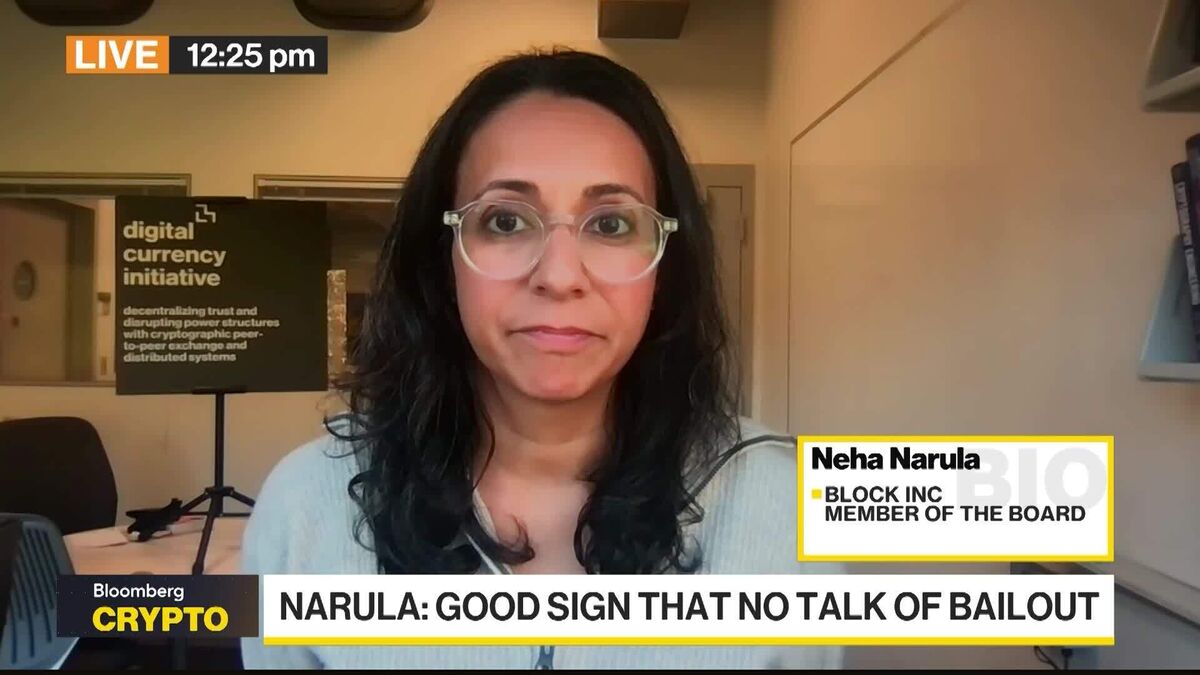

Crypto Ecosystem Actually ‘Worked’ During Crash, Digital Currency Expert Says

PositiveFinancial Markets

Last weekend's crypto selloff has been deemed a non-issue by an MIT digital currency expert, who argues that it demonstrates the market's experimental nature and resilience. This perspective is crucial as it reassures investors that the crypto ecosystem is functioning as intended, even during turbulent times, highlighting the importance of understanding market dynamics.

— Curated by the World Pulse Now AI Editorial System