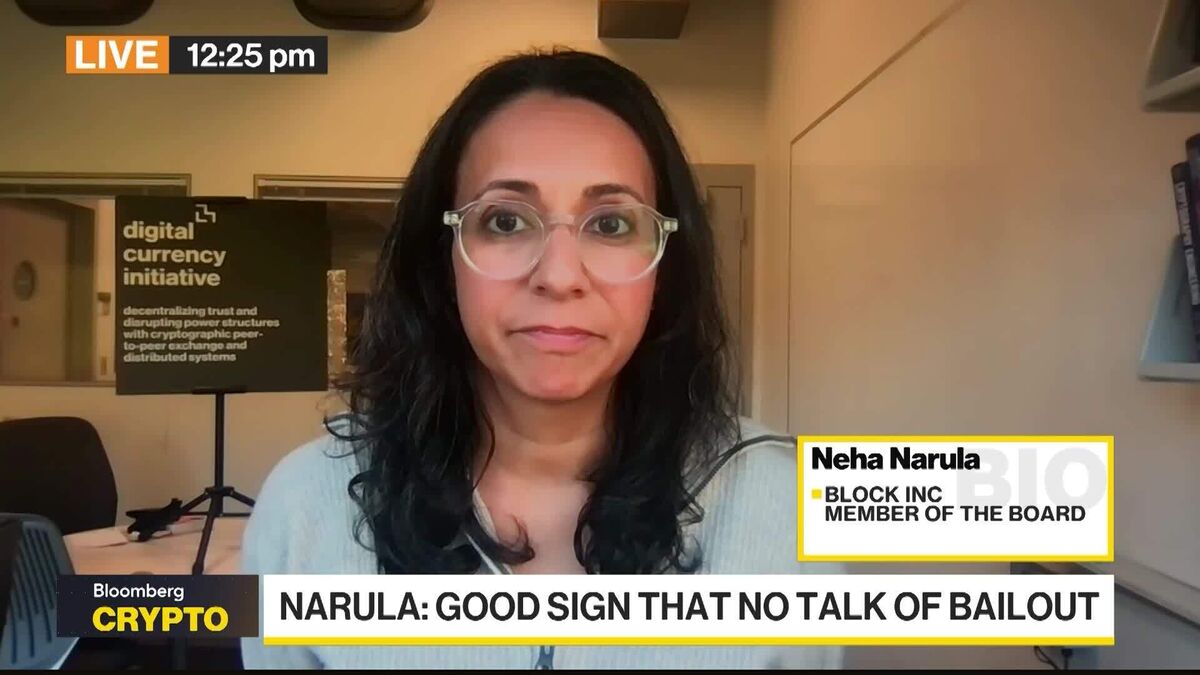

MIT Grad Brothers’ Trial Puts Focus on ‘Wild West’ Crypto Trades

NeutralFinancial Markets

This week, two brothers who recently graduated from MIT are facing trial, which is expected to bring attention to a controversial cryptocurrency trading strategy. This case is significant as it highlights the often opaque and unregulated nature of crypto trades, raising questions about legality and ethics in the rapidly evolving digital currency landscape.

— Curated by the World Pulse Now AI Editorial System