Gold prices slide further as easing US-China tensions curb haven demand

NegativeFinancial Markets

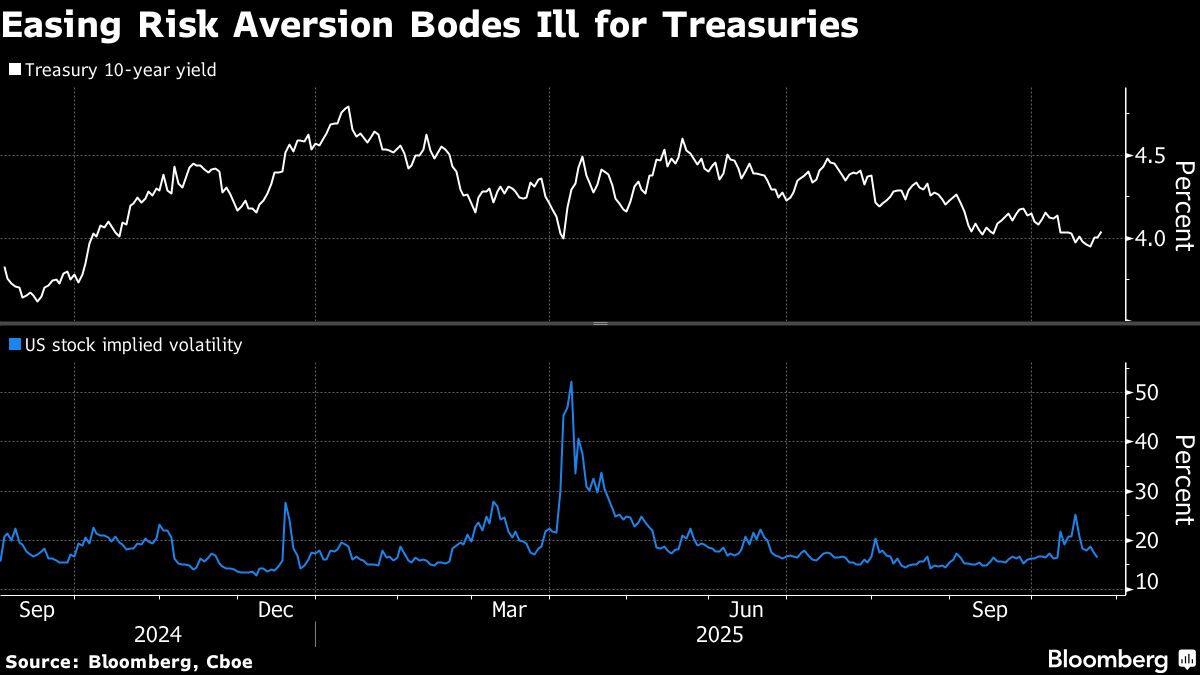

Gold prices have continued to decline as easing tensions between the US and China reduce the demand for safe-haven assets. This shift in market sentiment is significant because it reflects a growing confidence among investors in the stability of the global economy, which could lead to changes in investment strategies and market dynamics.

— Curated by the World Pulse Now AI Editorial System