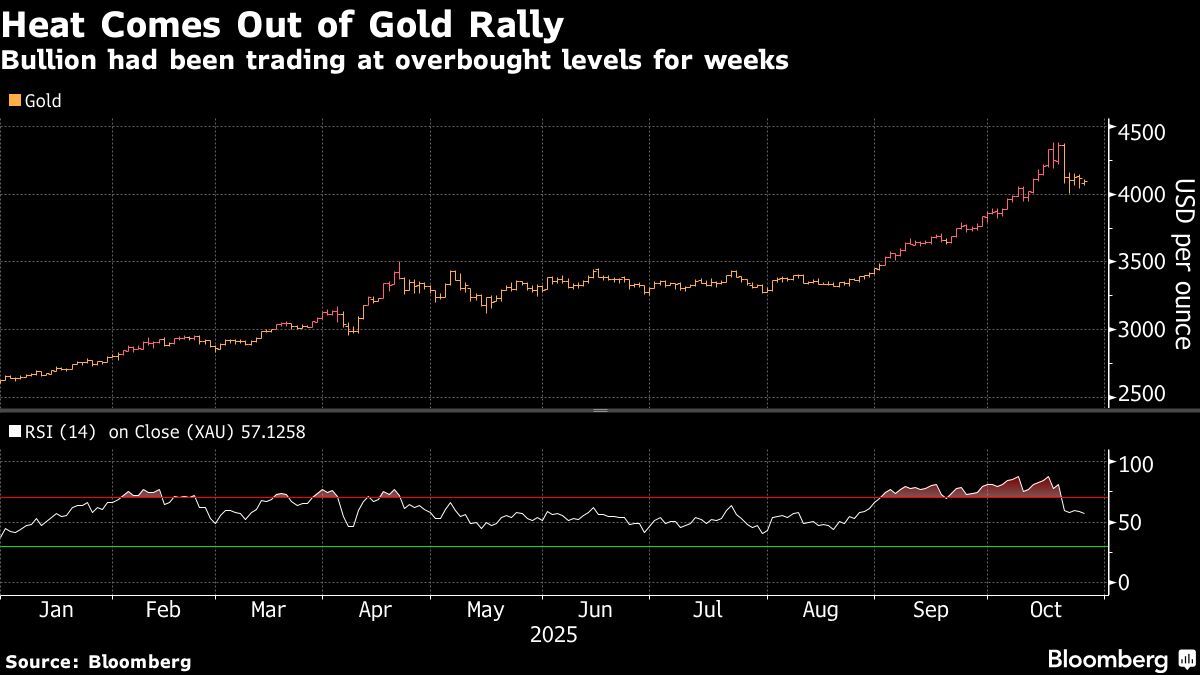

Comex Gold Futures Consolidating Above 20-Day Simple Moving Average, Chart Shows

PositiveFinancial Markets

Comex gold futures are showing strong signs of stability, consolidating above the 20-day simple moving average, according to RHB. This trend suggests that gold prices could continue to rise, potentially reaching $4,400. This is significant for investors as it indicates a bullish outlook for gold, which is often seen as a safe haven during economic uncertainty.

— Curated by the World Pulse Now AI Editorial System