Stock Market Today: Gold Extends Rally; Nasdaq Rises

PositiveFinancial Markets

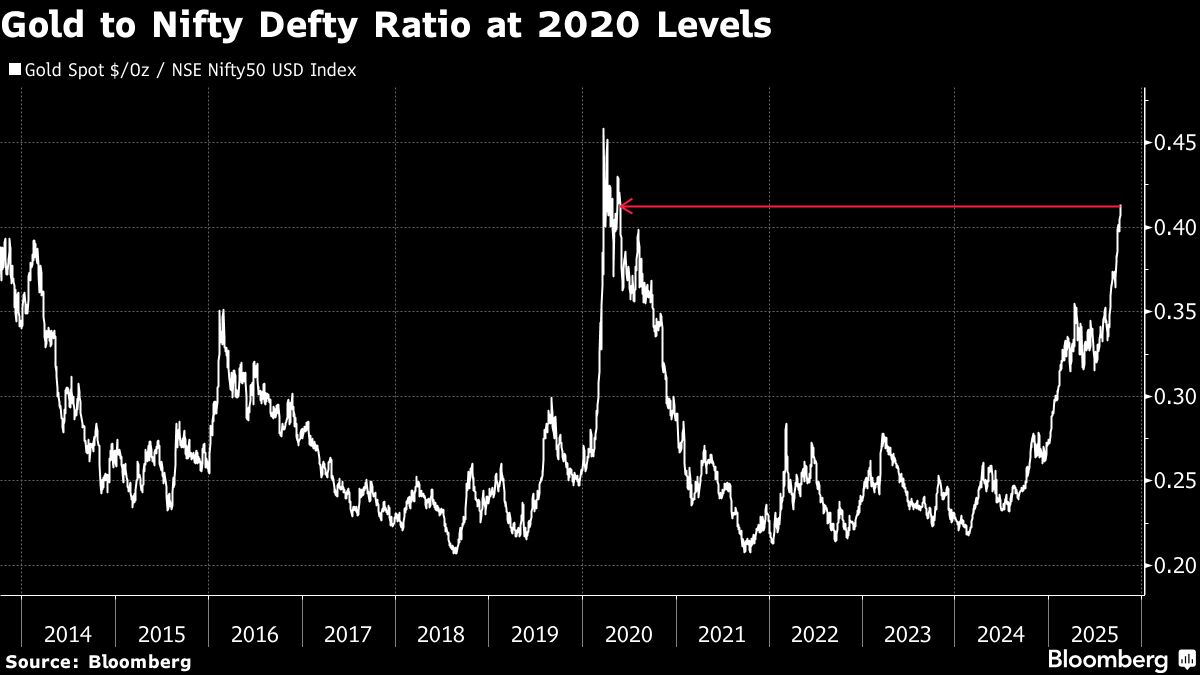

Today, the stock market is buzzing with positive news as gold prices continue their rally, signaling strong investor confidence. The Nasdaq has also seen a rise, reflecting a broader trend of recovery in tech stocks. Additionally, silver prices are climbing, approaching a long-time record, which highlights the growing interest in precious metals as safe-haven assets. This upward movement in the market is significant as it suggests a potential rebound in economic activity and investor sentiment.

— Curated by the World Pulse Now AI Editorial System