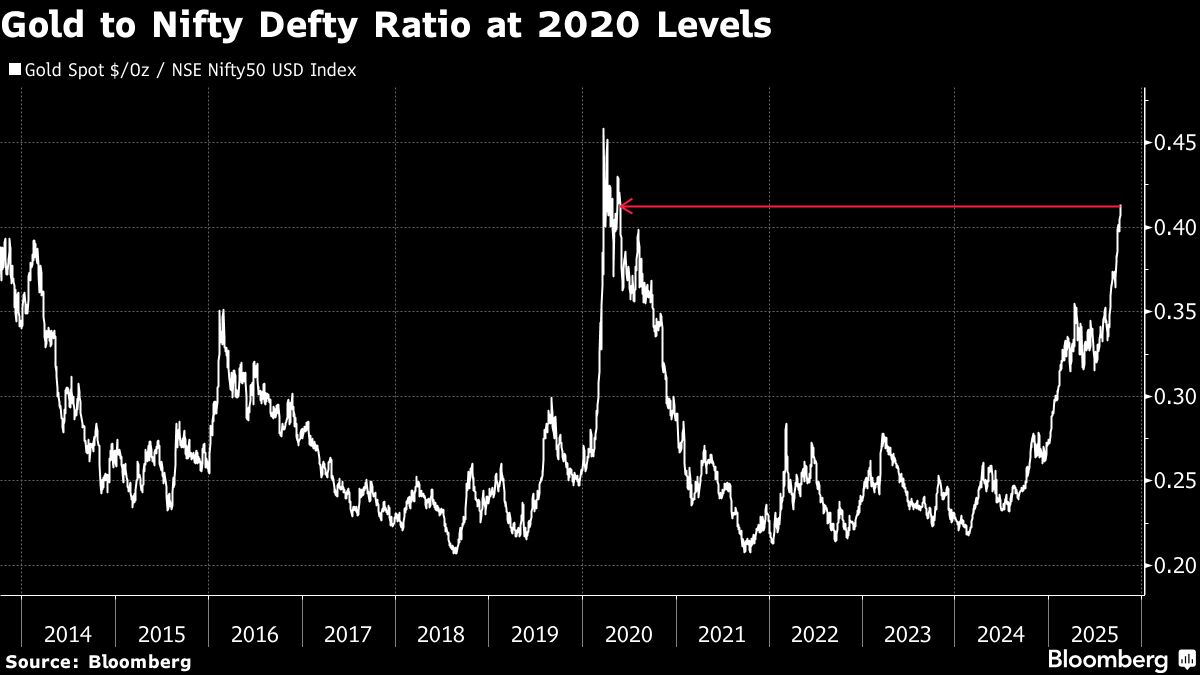

Gold Outperforms Indian Equities in Dollar Terms as IPO Gains Fade

NeutralFinancial Markets

In the latest market analysis, gold has shown stronger performance compared to Indian equities when measured in dollar terms, particularly as the excitement surrounding recent IPO gains begins to wane. This shift is significant as it highlights the changing dynamics in investment preferences, especially in a volatile market. Investors may need to reassess their strategies as gold emerges as a more stable asset amidst fluctuating stock performances.

— Curated by the World Pulse Now AI Editorial System