UK Export Orders Fall at Fastest Pace in Five Months, PMI Shows

NegativeFinancial Markets

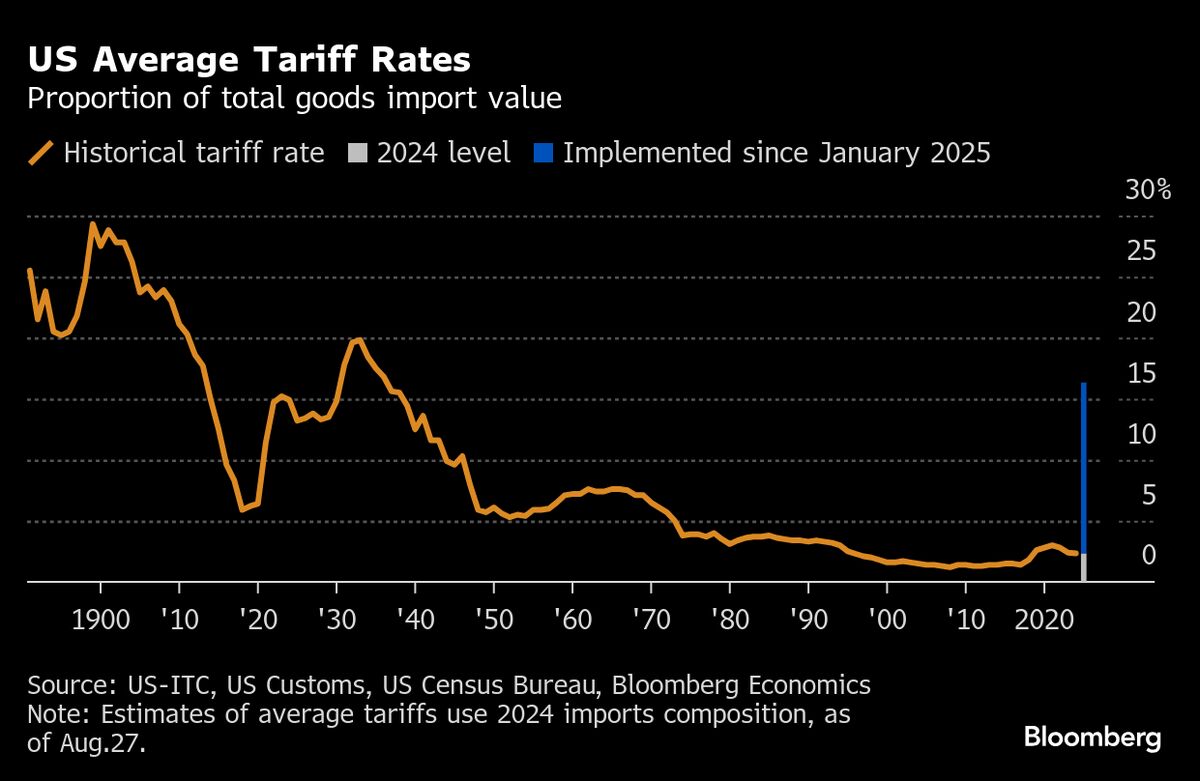

The latest PMI survey reveals that demand for British exports has dropped at the fastest rate in five months, a concerning trend reminiscent of the market's reaction to US President Donald Trump's global tariffs. This decline is significant as it highlights potential challenges for the UK economy, particularly in the context of international trade relations.

— Curated by the World Pulse Now AI Editorial System