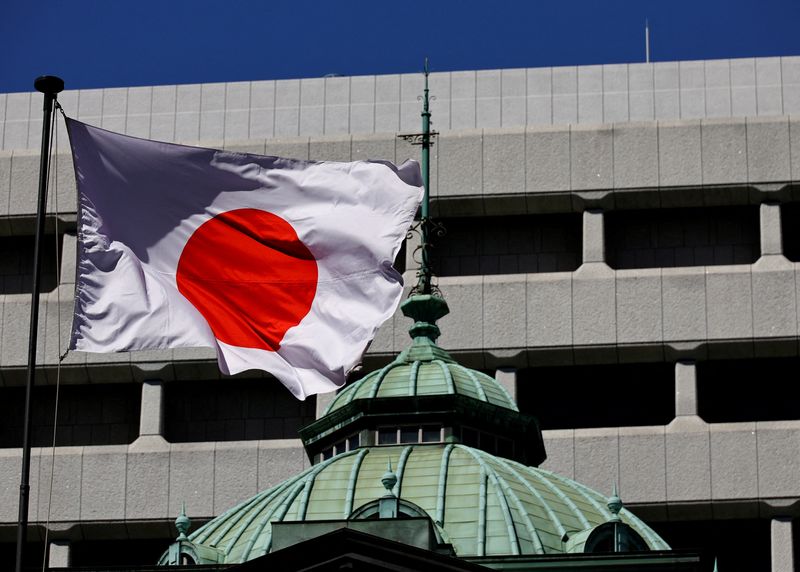

If BOJ Falls Behind Curve, Catching Up Could Hurt Economy, Board Member Says

NeutralFinancial Markets

Naoki Tamura, a board member of the Bank of Japan, has indicated that the central bank should consider resuming interest rate increases. This statement highlights the ongoing discussions about monetary policy in Japan and its potential impact on the economy. As inflationary pressures continue, the BOJ's decisions will be crucial in shaping economic stability and growth.

— Curated by the World Pulse Now AI Editorial System