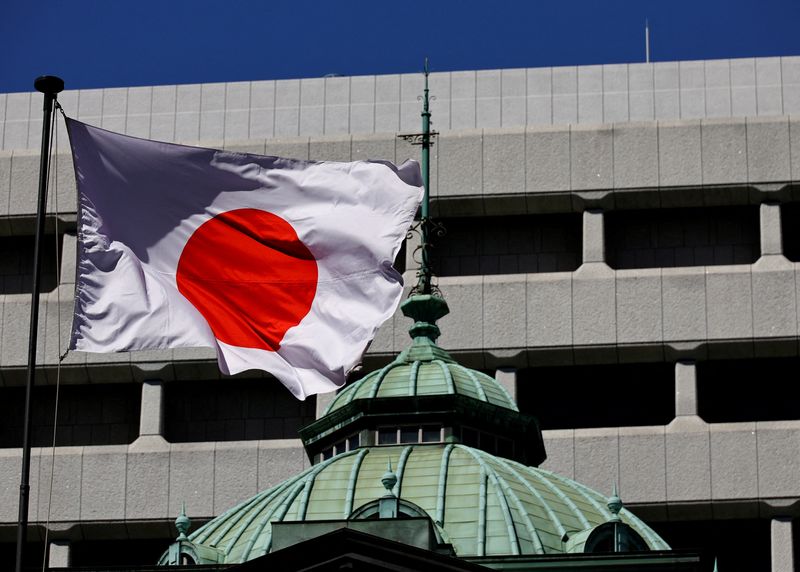

Bessent says yen will find its own level if Bank of Japan follows ’proper’ policy

PositiveFinancial Markets

Bessent has expressed optimism about the future of the yen, suggesting that it will stabilize if the Bank of Japan implements the right policies. This is significant as it indicates a potential shift in Japan's monetary strategy, which could impact global markets and investor confidence.

— Curated by the World Pulse Now AI Editorial System