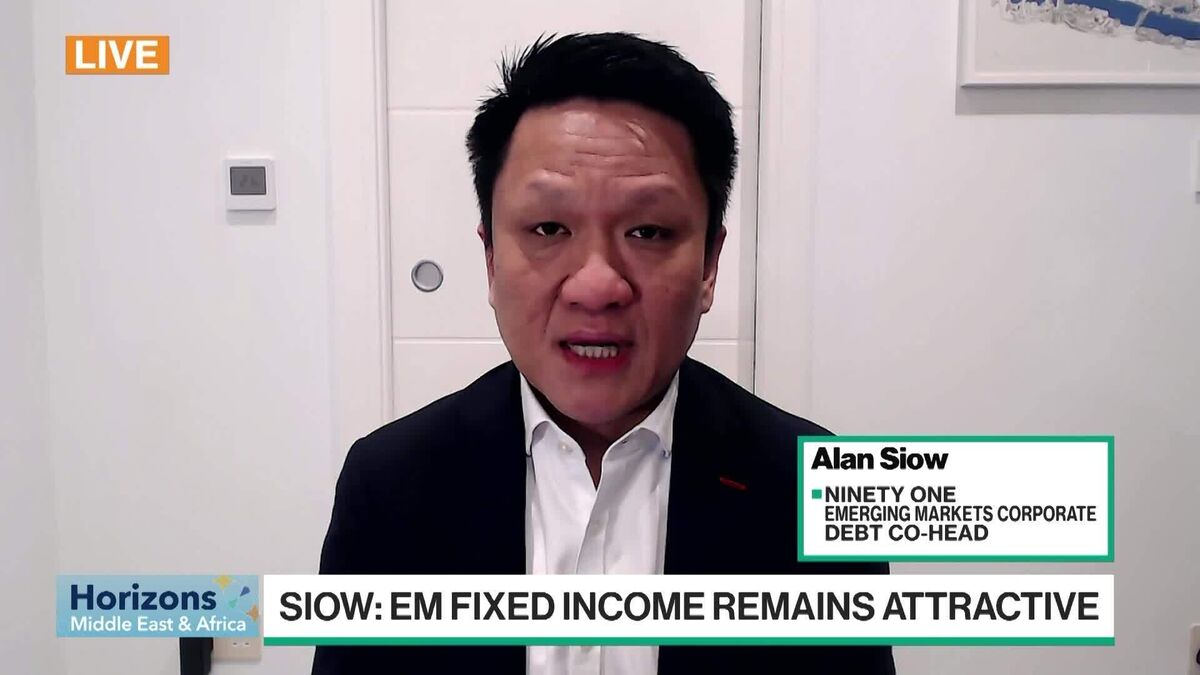

Siow: Saudi Riyal’s Entry Into EM Similar to China

PositiveFinancial Markets

Emerging market stocks are experiencing a significant upswing, marking their longest winning streak since February 2024, driven by increased risk appetite ahead of the Federal Reserve's crucial rate decision. Alan Siow from Ninety One shared insights on this trend during a discussion with Bloomberg, highlighting the uncertainty surrounding the Fed's actions and the growing role of Saudi Arabia in emerging markets. This is important as it reflects investor confidence and could signal broader economic trends.

— Curated by the World Pulse Now AI Editorial System