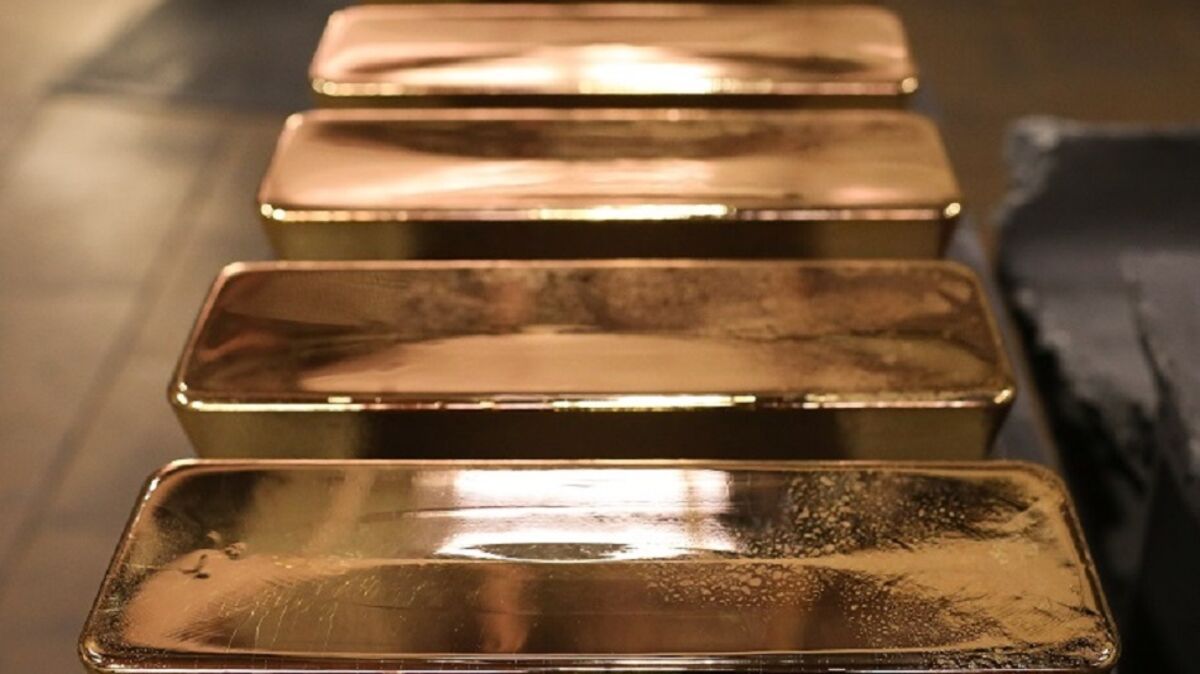

ING forecasts average gold price of $4,150 per ounce in 2026 amid central bank buy

PositiveFinancial Markets

ING has made an optimistic forecast, predicting that the average price of gold will reach $4,150 per ounce by 2026. This projection is largely driven by increased buying from central banks, which signals a growing confidence in gold as a safe-haven asset. Such a significant rise in gold prices could have major implications for investors and the global economy, highlighting gold's enduring appeal in times of uncertainty.

— Curated by the World Pulse Now AI Editorial System