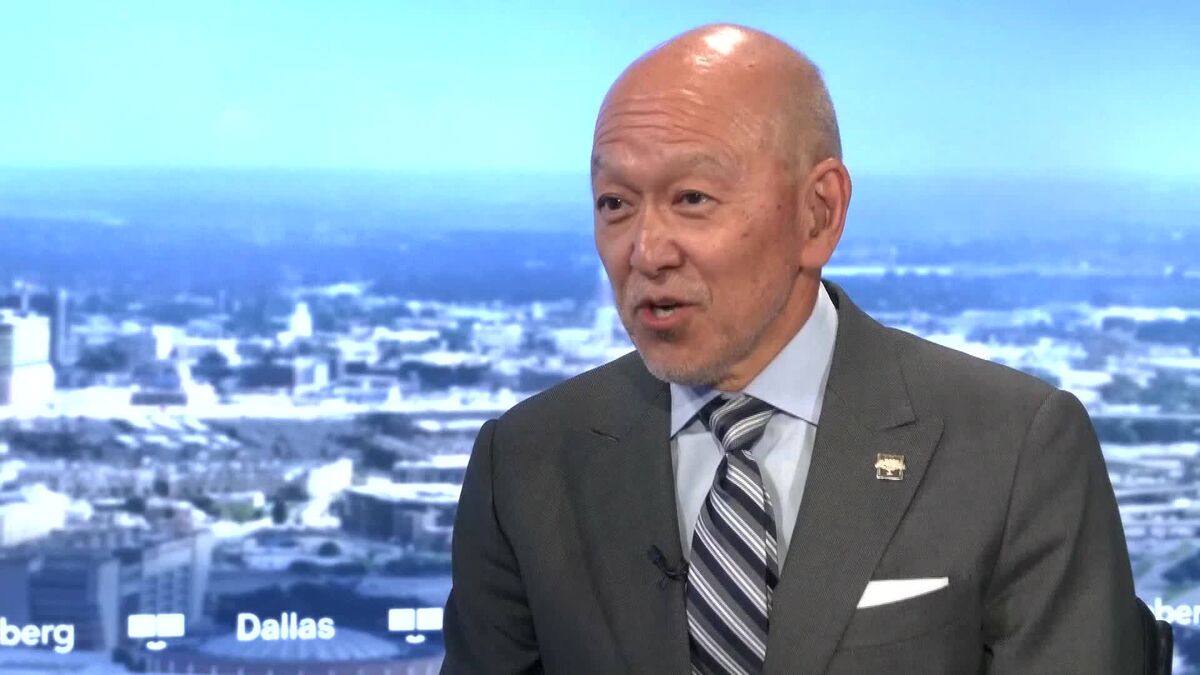

Sycamore's Okada on the Dollar, Tariffs, Japan Trade

NeutralFinancial Markets

Mark Okada, co-founder and CEO of Sycamore Tree Capital Partners, recently discussed the current state of credit markets, the US dollar, and the trade deal with Japan in an interview with Bloomberg. This conversation is significant as it sheds light on the complexities of international trade and currency valuation, which can impact investors and the broader economy.

— Curated by the World Pulse Now AI Editorial System