US financial regulators start shuttering as federal funding runs out

NegativeFinancial Markets

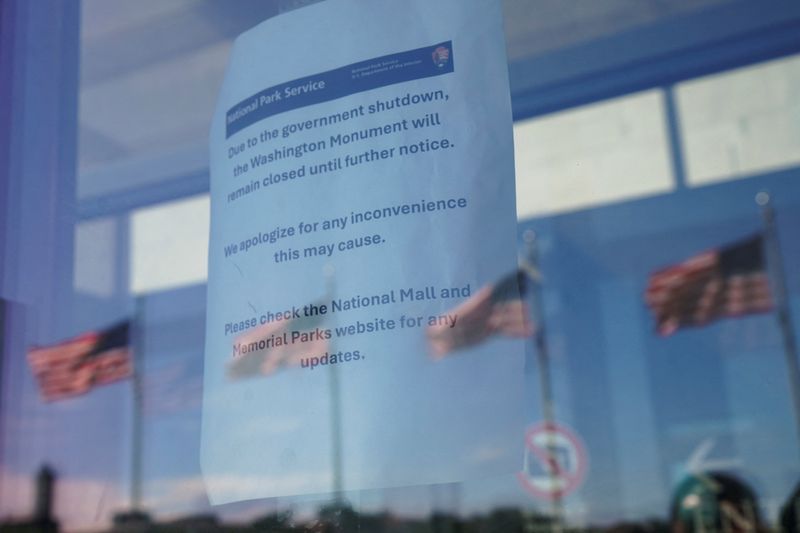

US financial regulators are beginning to shut down operations as federal funding has run out, raising concerns about the stability of the financial system. This situation is critical as it could lead to disruptions in oversight and enforcement, potentially impacting markets and consumer confidence. The implications of these shutdowns could ripple through the economy, affecting everything from banking to investments.

— Curated by the World Pulse Now AI Editorial System