US permits Trinidad and Tobago to negotiate gas deal with Venezuela

PositiveFinancial Markets

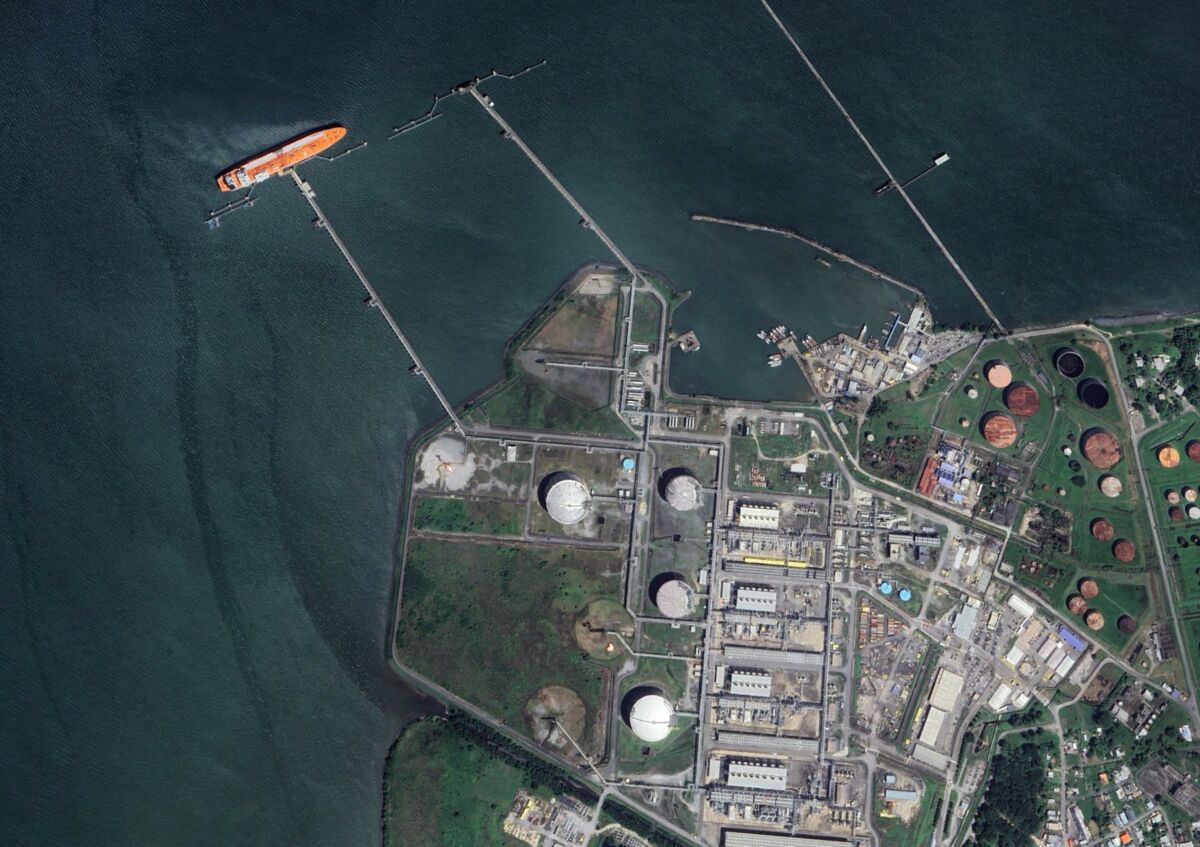

The U.S. has granted Trinidad and Tobago permission to negotiate a gas deal with Venezuela, marking a significant step forward for energy collaboration in the region. This authorization allows a Shell-led project to proceed after facing years of disruptions due to sanctions. This development is crucial as it not only enhances energy security for Trinidad and Tobago but also opens up new avenues for economic growth and cooperation in the Caribbean.

— Curated by the World Pulse Now AI Editorial System