Dollar Scholar Asks: Is Buying a Timeshare a Good Investment?

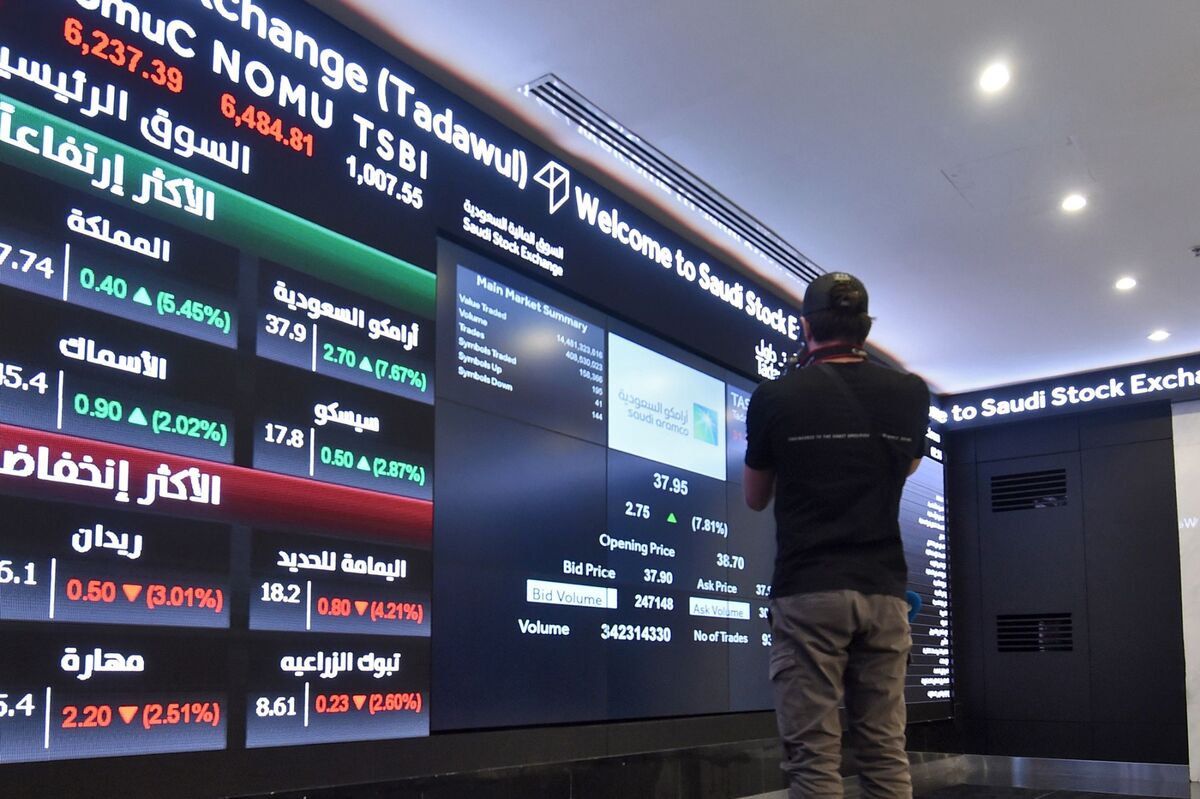

NeutralFinancial Markets

Timeshares are making a comeback, offering more destinations and user-friendly points systems, but the question remains: is purchasing one a wise financial decision? This article explores the pros and cons of timeshares, helping potential buyers understand whether this investment aligns with their financial goals.

— Curated by the World Pulse Now AI Editorial System