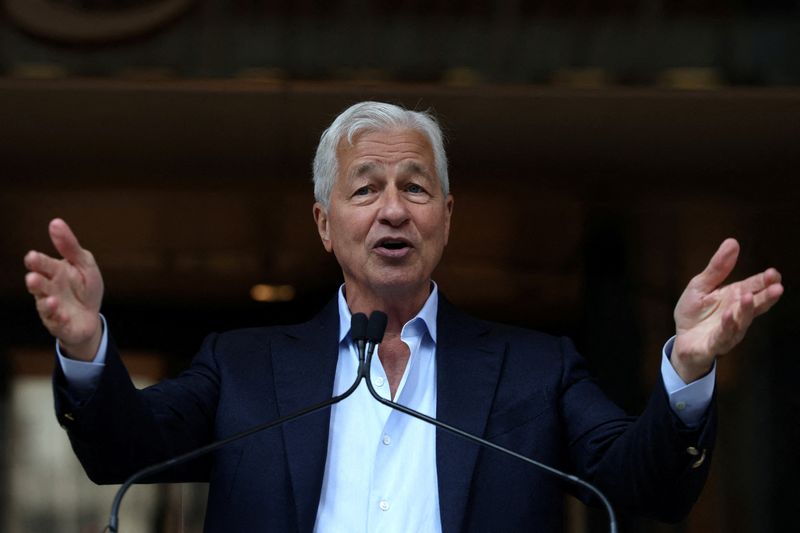

JPMorgan downgrades FedEx stock to Neutral on LTL concerns

NegativeFinancial Markets

JPMorgan has downgraded FedEx's stock to neutral due to concerns surrounding its less-than-truckload (LTL) services. This decision reflects the bank's cautious outlook on FedEx's performance in a challenging logistics environment. Investors should pay attention to this downgrade as it may impact FedEx's stock price and overall market perception.

— Curated by the World Pulse Now AI Editorial System