Japanese Stocks Set to Rise Following US Markets Rally, BOJ Eyed

PositiveFinancial Markets

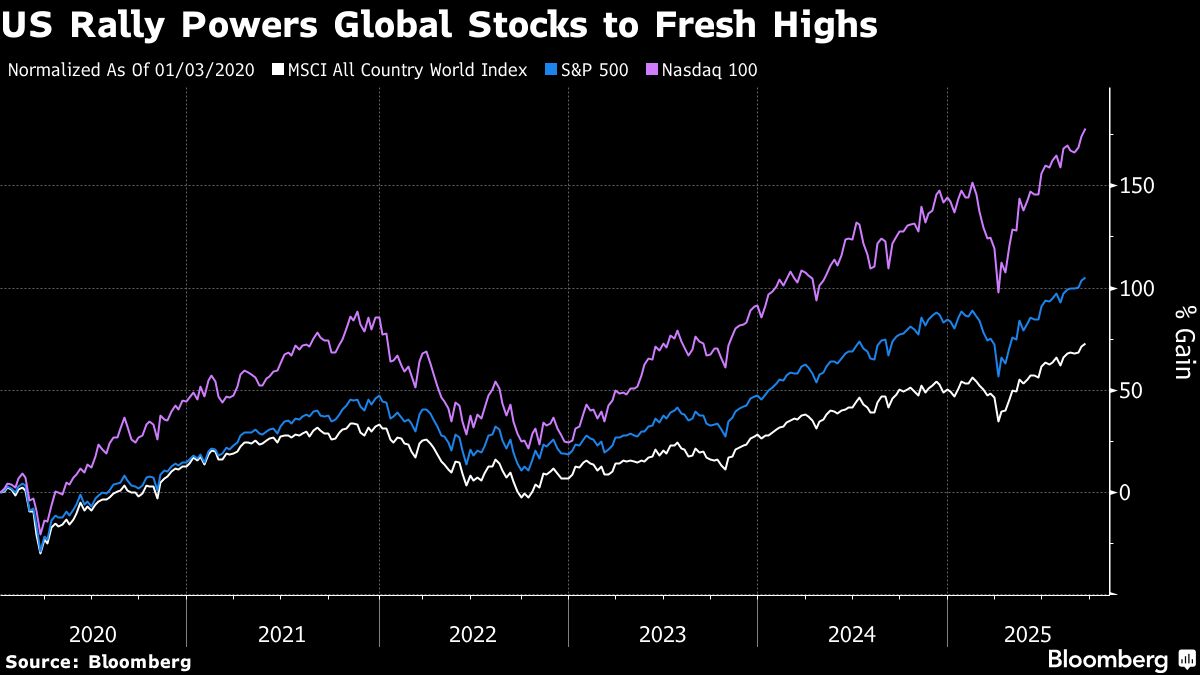

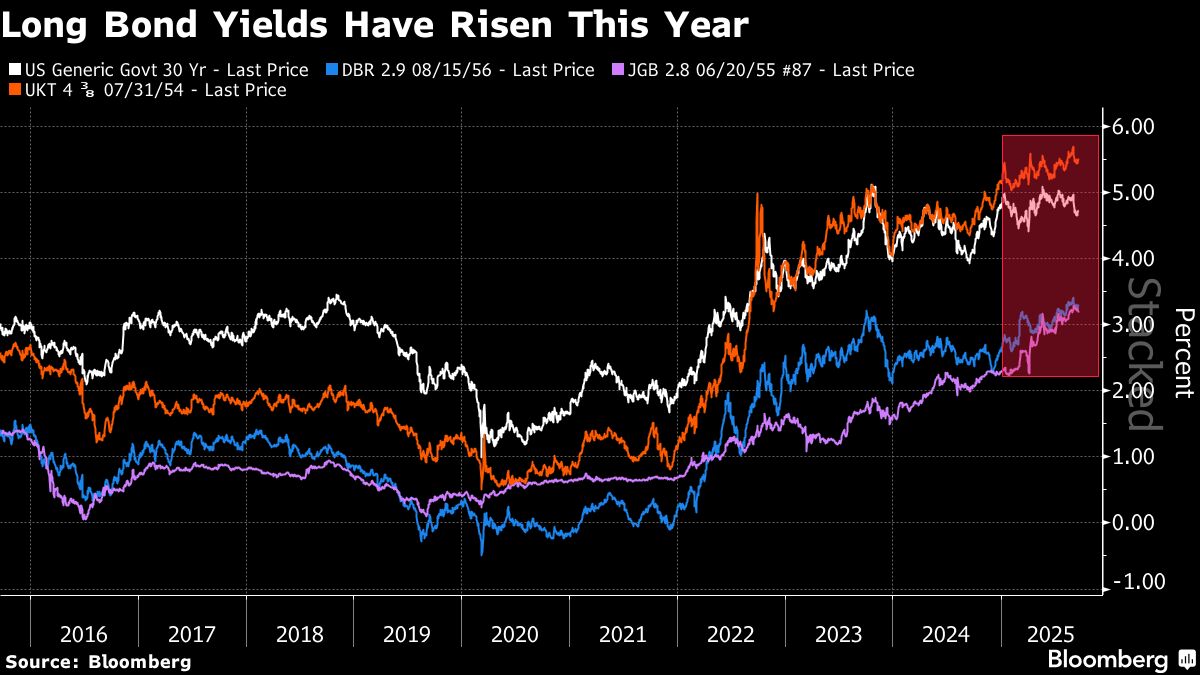

Japanese stocks are expected to rise on Friday, buoyed by a rally in US markets that reached new highs after the Federal Reserve's first interest-rate cut of the year. This positive momentum is significant as it reflects investor confidence and could lead to further gains in the Japanese market. Additionally, all eyes are on the Bank of Japan's upcoming decision, which could influence market dynamics even further.

— Curated by the World Pulse Now AI Editorial System