Nvidia Invests $5B in Intel | Bloomberg Businessweek Daily 9/18/2025

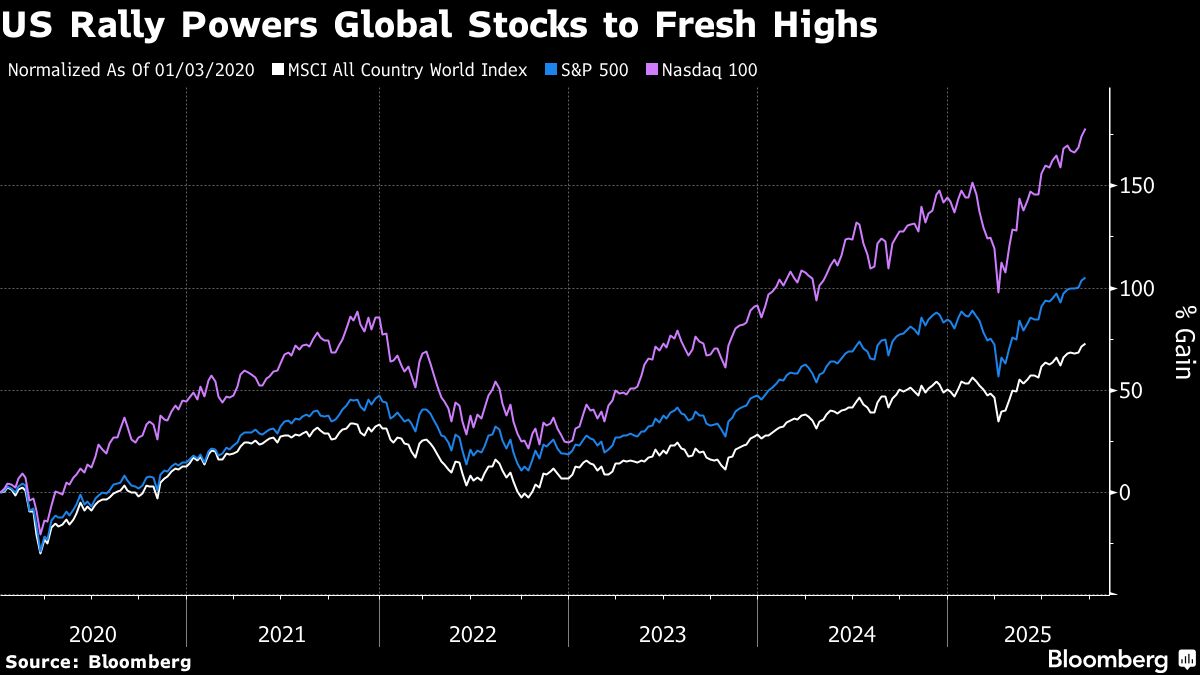

PositiveFinancial Markets

In a significant move, Nvidia has announced a $5 billion investment in Intel, signaling a strong partnership between the two tech giants. This investment not only highlights Nvidia's confidence in Intel's future but also reflects the growing importance of collaboration in the tech industry. The discussion on Bloomberg Businessweek Daily sheds light on the implications of this partnership, as experts analyze how it could reshape the competitive landscape. Additionally, the episode touches on other pressing topics, including Trump's ongoing efforts regarding the Federal Reserve, making it a must-listen for those interested in the intersection of technology and finance.

— Curated by the World Pulse Now AI Editorial System