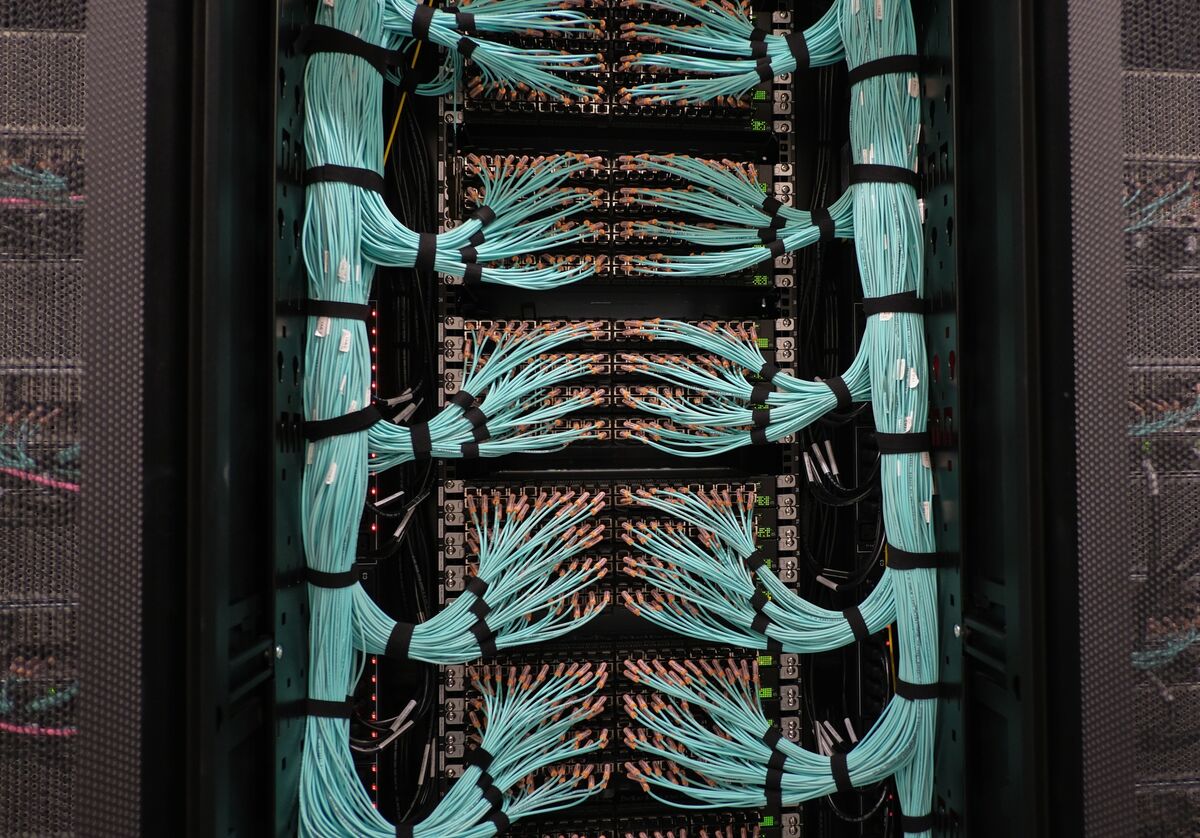

Boost Run Set to Go Public in US Via $614 Million SPAC Merger

PositiveFinancial Markets

Boost Run LLC, an AI cloud infrastructure company, is set to go public on the Nasdaq through a $614 million merger with Willow Lane Acquisition Corp.

Editor’s Note: This merger is significant as it highlights the growing interest and investment in AI technologies, potentially paving the way for more innovations in the cloud infrastructure sector.

— Curated by the World Pulse Now AI Editorial System