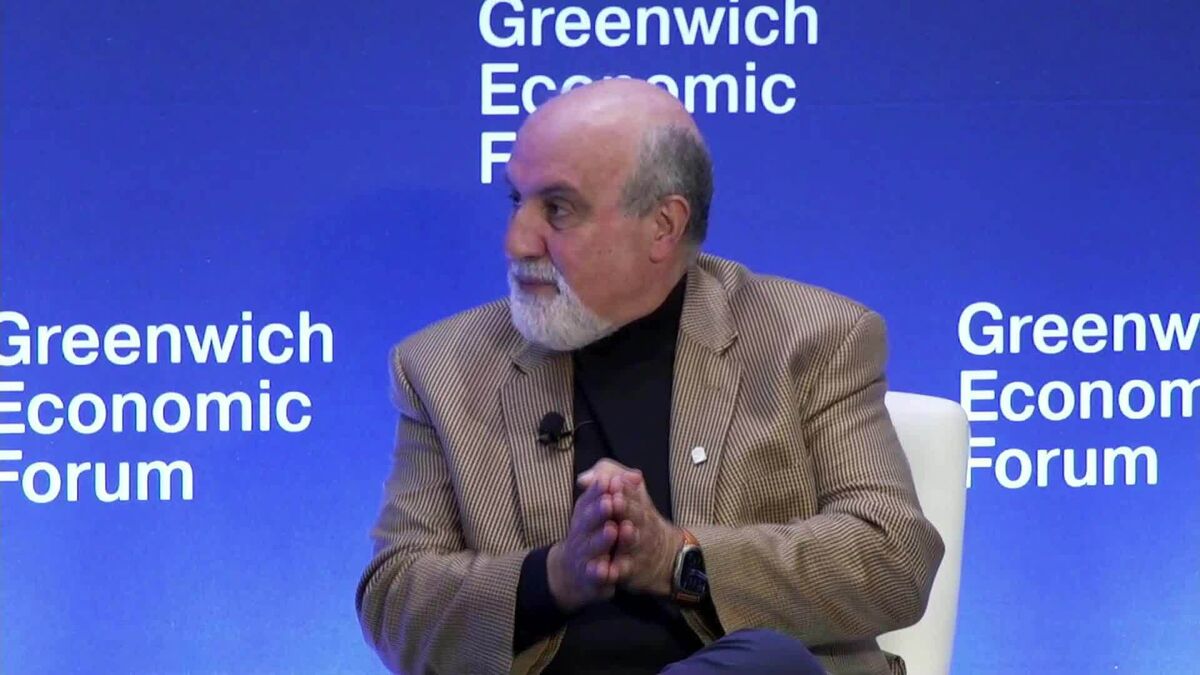

Bloomberg Brief 10/10/2025 (Video)

NeutralFinancial Markets

The Bloomberg Brief video released on October 10, 2025, provides a concise overview of the latest developments in finance and market trends. This video is significant as it helps viewers stay informed about critical economic changes and investment opportunities, making it a valuable resource for both casual viewers and financial professionals.

— Curated by the World Pulse Now AI Editorial System