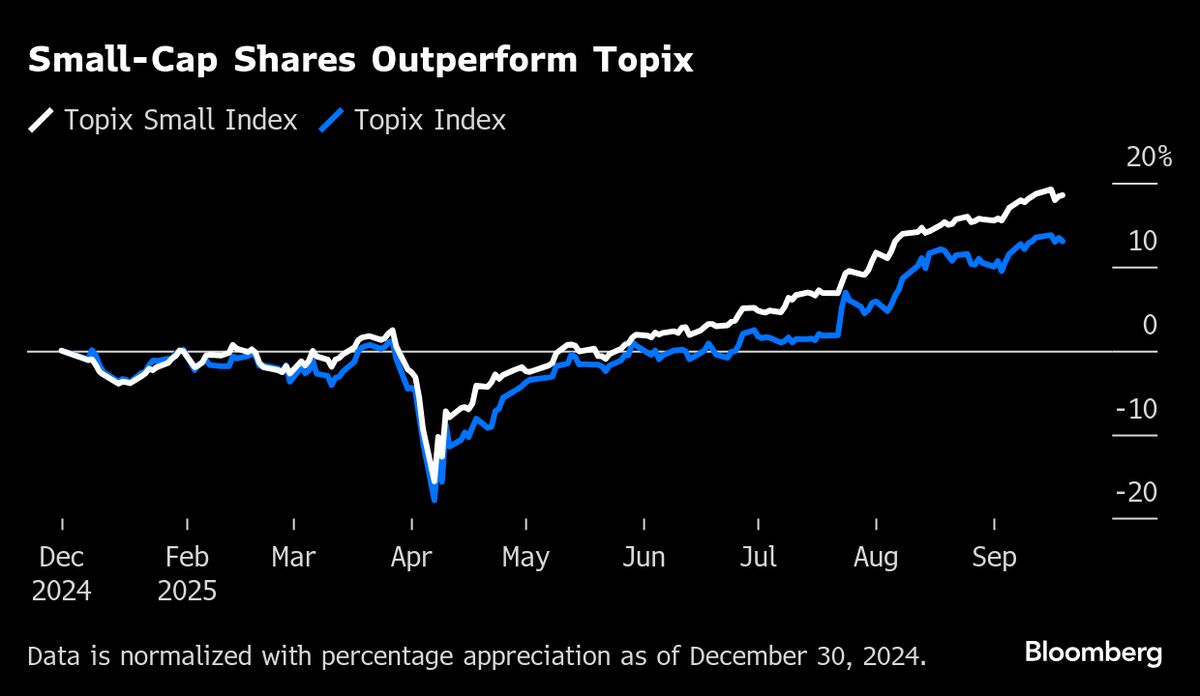

US Hedge Fund Verdad Plans to Launch New Japan Small-Cap Fund

PositiveFinancial Markets

Boston-based hedge fund Verdad Advisers LP is set to launch a new Japanese equity fund that will focus on small-cap companies. This move highlights a growing trend among global investors who are seeking to tap into the potential of Japan's revitalized stock market, moving beyond traditional blue-chip stocks. It's an exciting development that could lead to new opportunities for investors looking to diversify their portfolios.

— Curated by the World Pulse Now AI Editorial System