Stocks Rally After Nvidia’s ‘Off the Chart Sales’; Fed December Rate Cut In Doubt | The Pulse 11/20

PositiveFinancial Markets

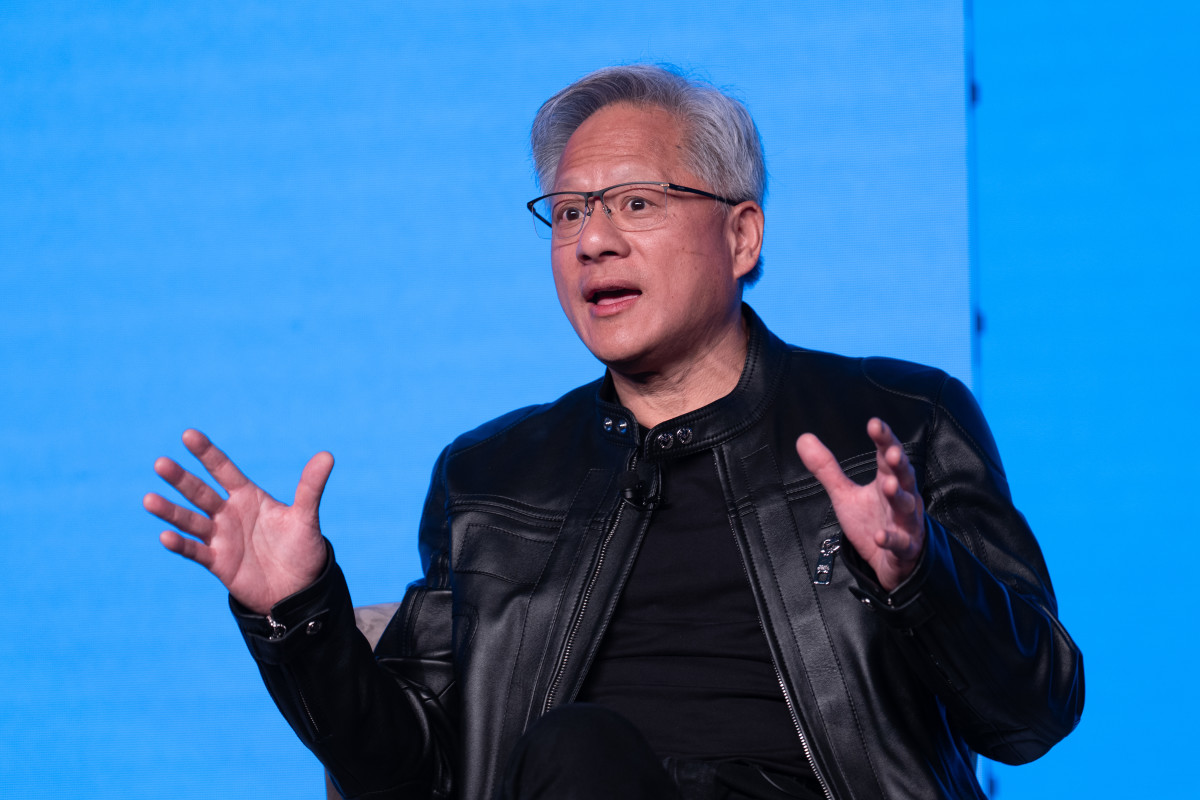

- Nvidia's strong sales forecast has led to a significant rally in stock markets, alleviating fears of a potential slowdown in the AI sector. This positive sentiment was reflected in the discussions on The Pulse With Francine Lacqua.

- The company's projected sales of approximately $65 billion for the January quarter, exceeding analysts' expectations, underscores Nvidia's pivotal role in the tech industry.

- The broader market dynamics are influenced by shifting narratives around the Federal Reserve and ongoing debates about the sustainability of the AI boom.

— via World Pulse Now AI Editorial System