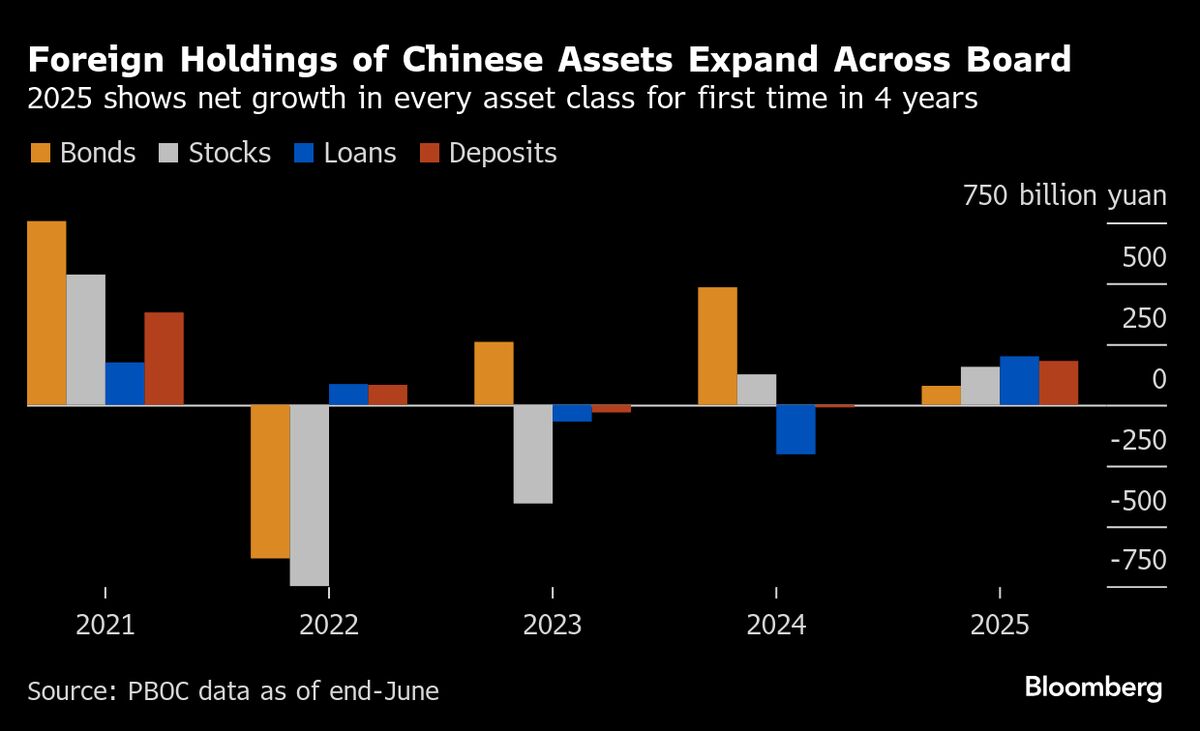

China’s Markets Shed ‘Uninvestable’ Tag as Global Funds Return

PositiveFinancial Markets

After years of hesitance, global money managers are once again looking to invest in China, driven by a remarkable stock rally and the country's progress in high-tech sectors. This shift is significant as it indicates renewed confidence in China's market, which had previously been labeled 'uninvestable.' The return of these funds could lead to increased economic activity and innovation in the region, making it a pivotal moment for both investors and the Chinese economy.

— Curated by the World Pulse Now AI Editorial System