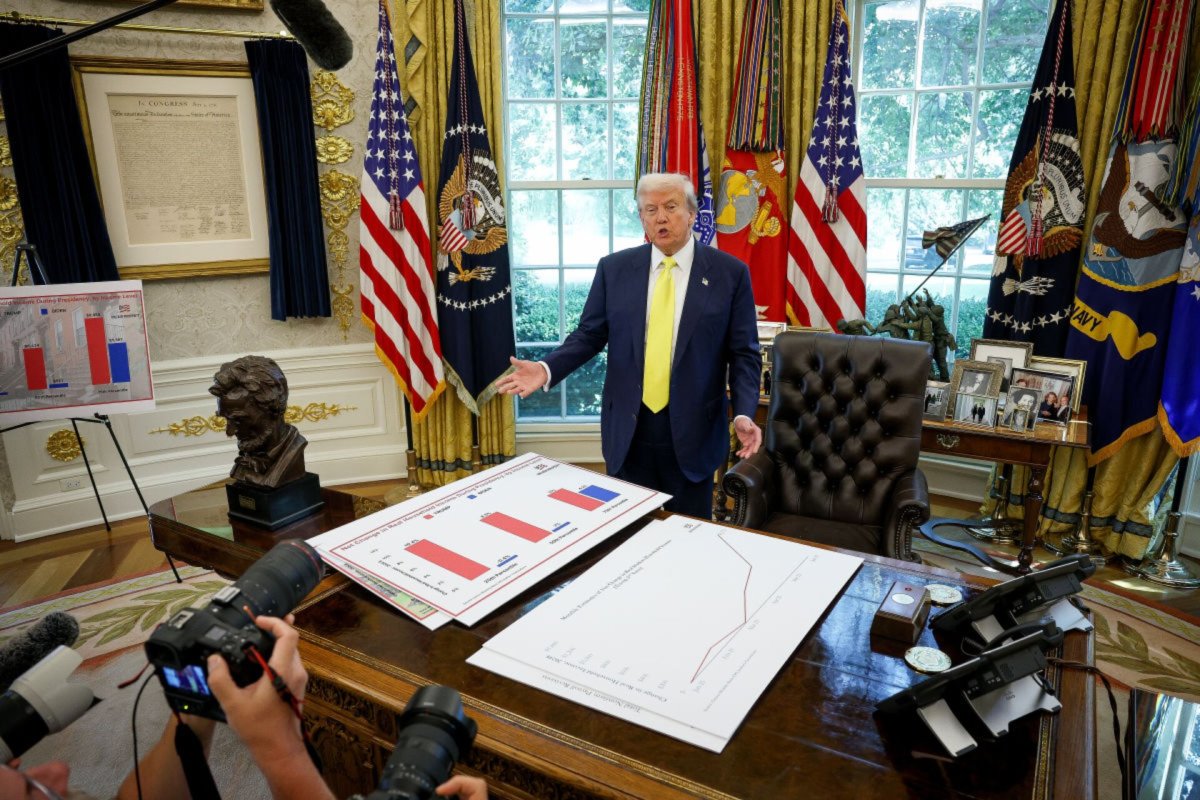

‘After last week’s meeting, I see monetary policy as barely restrictive, if at all,’ Cleveland Fed leader Beth Hammack says

NeutralFinancial Markets

‘After last week’s meeting, I see monetary policy as barely restrictive, if at all,’ Cleveland Fed leader Beth Hammack says

Cleveland Fed leader Beth Hammack recently expressed her views on the current state of monetary policy, suggesting it is only slightly restrictive, if at all. She raised concerns about the possibility of further interest-rate cuts due to ongoing inflation and the effects of previous rate reductions. This matters because it highlights the challenges the Federal Reserve faces in balancing economic growth with inflation control, which could impact financial markets and consumer confidence.

— via World Pulse Now AI Editorial System