US Government Shutdown Becomes Longest in History

NegativeFinancial Markets

US Government Shutdown Becomes Longest in History

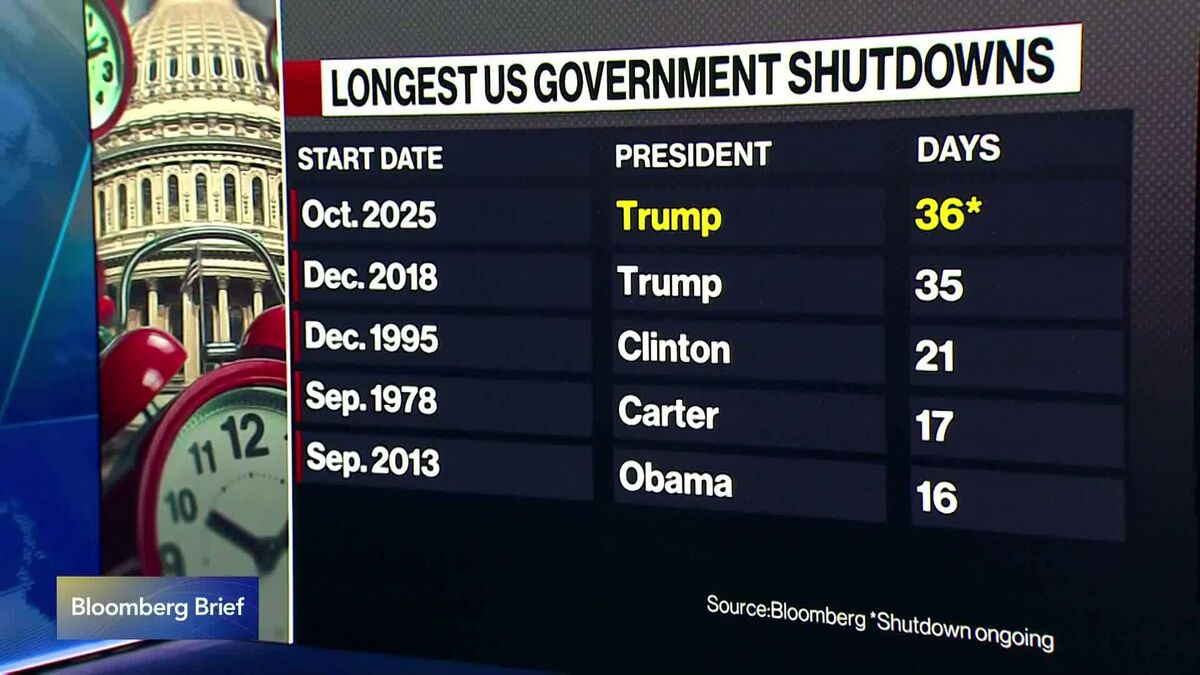

The US government shutdown has now reached its 36th day, marking the longest shutdown in history, surpassing the previous record from early 2019. This prolonged closure is costing the economy between $10 billion and $30 billion each week, according to analysts. The situation is critical as it affects not only government operations but also the livelihoods of many Americans, highlighting the urgent need for a resolution.

— via World Pulse Now AI Editorial System