Ferrari Shares Plunge In Worst Day Ever As Guidance Worries Analysts

NegativeFinancial Markets

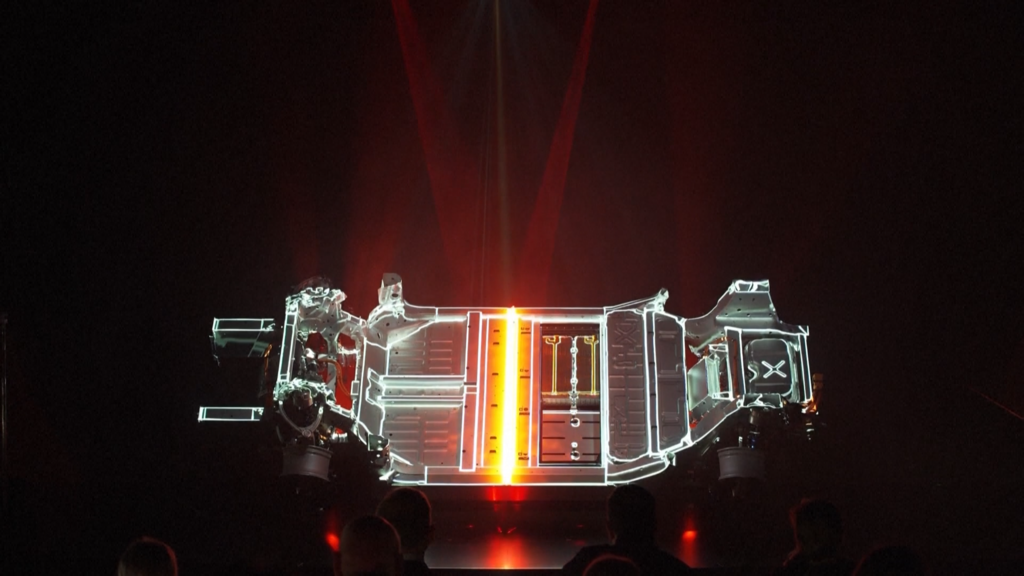

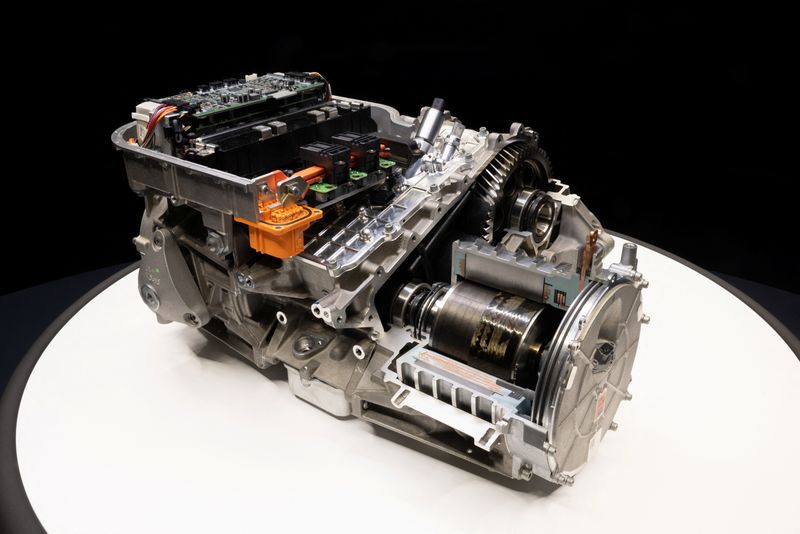

Ferrari's shares have taken a significant hit, marking the worst day in the company's history as analysts express concerns over its future guidance. The luxury automaker has also lowered expectations for its new electric vehicle business, raising questions about its ability to compete in the evolving automotive market. This news is crucial as it reflects the challenges faced by traditional car manufacturers in adapting to new technologies and consumer demands.

— Curated by the World Pulse Now AI Editorial System