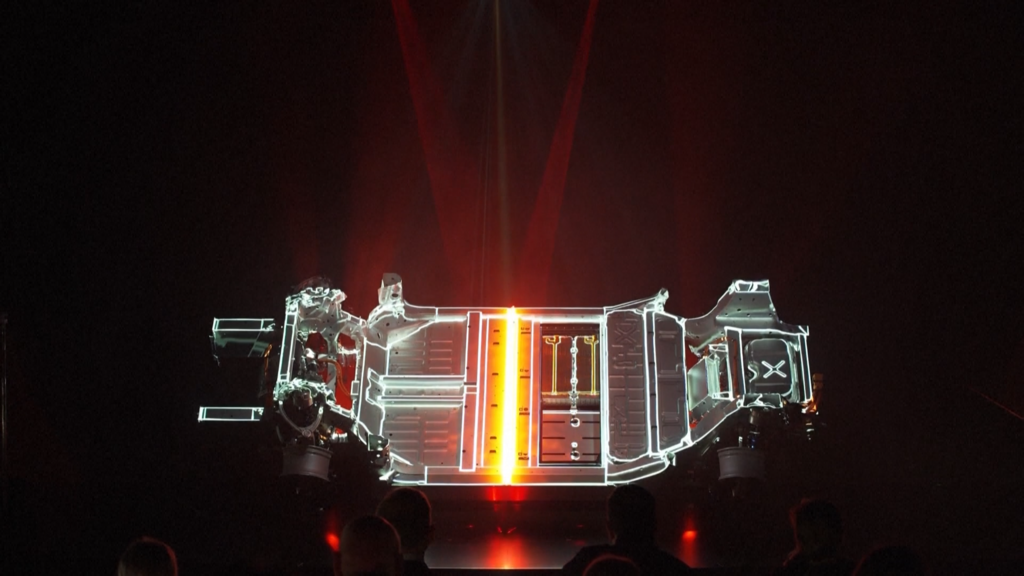

Ferrari unveils chassis of its first electric car, but shares plunge as financial outlook disappoints

NegativeFinancial Markets

Ferrari has introduced the chassis for its first electric car, set to launch next year, showcasing its new powertrain technology. However, the excitement is dampened by a disappointing financial outlook, as the company has revised its profit and revenue forecasts downward, leading to a 15% drop in its stock price. This news highlights the challenges Ferrari faces in balancing innovation with investor expectations, especially in a competitive market for electric vehicles.

— Curated by the World Pulse Now AI Editorial System