Amundi Physical Gold ETC issues 17,000 new securities

PositiveFinancial Markets

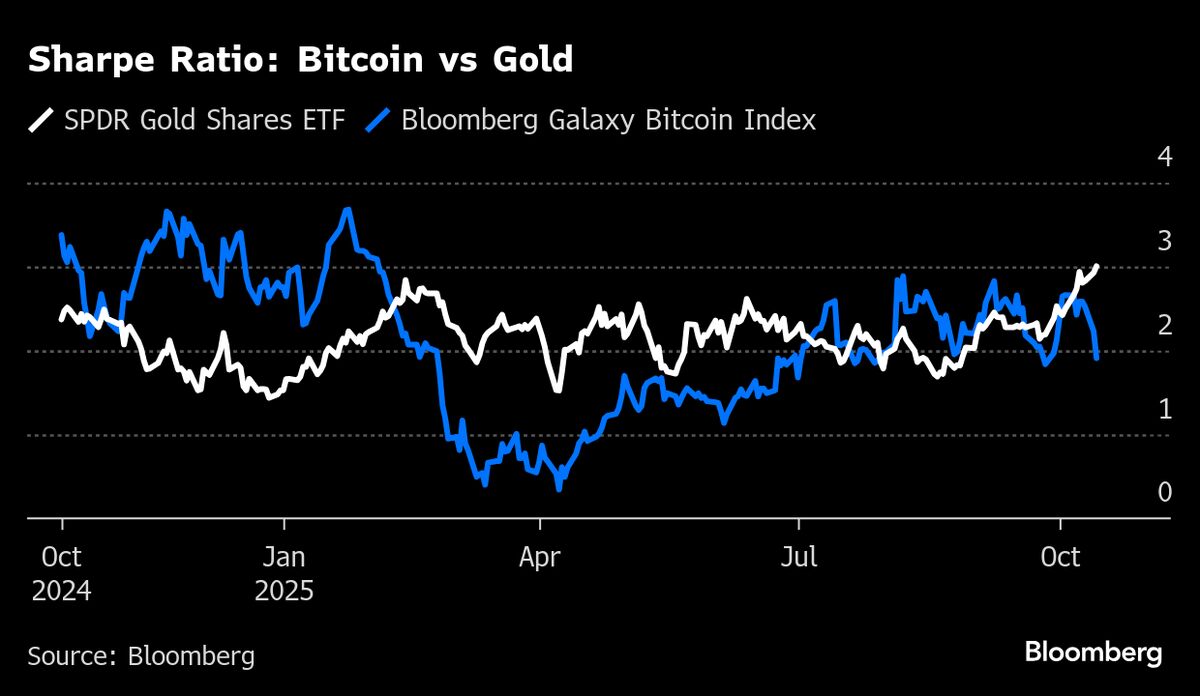

Amundi has announced the issuance of 17,000 new securities for its Physical Gold ETC, a move that reflects growing investor interest in gold as a safe-haven asset. This increase in securities not only enhances liquidity but also provides more opportunities for investors to diversify their portfolios with gold, which is often seen as a hedge against inflation and market volatility. As global economic uncertainties persist, this development is significant for both seasoned and new investors looking to secure their financial futures.

— Curated by the World Pulse Now AI Editorial System