Wall Street Tests Regulators’ Risk Appetite With 3x ETF Bids

NeutralFinancial Markets

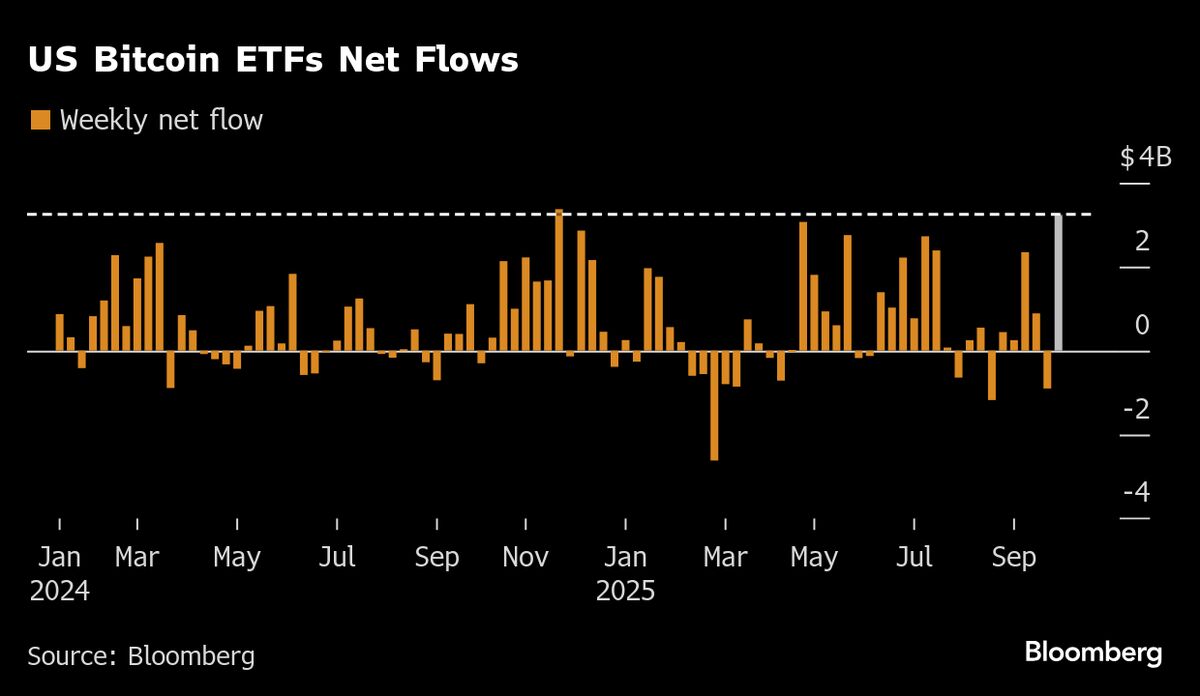

A group of money managers is looking to launch exchange-traded funds (ETFs) that significantly increase the volatility of assets like Tesla and Bitcoin. This move could challenge regulators' willingness to allow such high-risk financial products in the market. As these ETFs aim to amplify market swings, it raises important questions about investor protection and the overall stability of the financial system.

— Curated by the World Pulse Now AI Editorial System