Bitcoin Option Traders Eye $140,000 After Record-Setting Rally

PositiveFinancial Markets

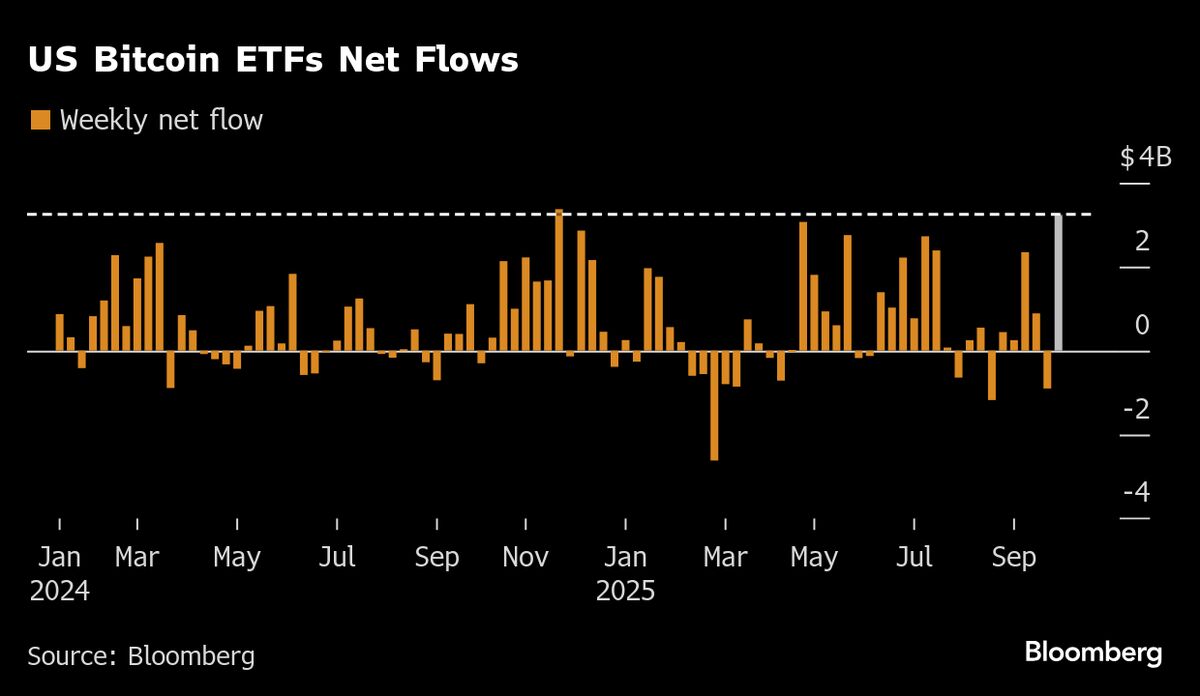

Bitcoin has surged to a new all-time high, sparking excitement among options traders who are now betting on the cryptocurrency reaching $140,000. This rally not only highlights the growing confidence in Bitcoin's value but also reflects a broader trend in the market where investors are increasingly optimistic about digital currencies. As more people engage with cryptocurrencies, this could lead to significant shifts in investment strategies and market dynamics.

— Curated by the World Pulse Now AI Editorial System