Europe Gas Traders Are Already Betting on Price Jump Next Summer

NeutralFinancial Markets

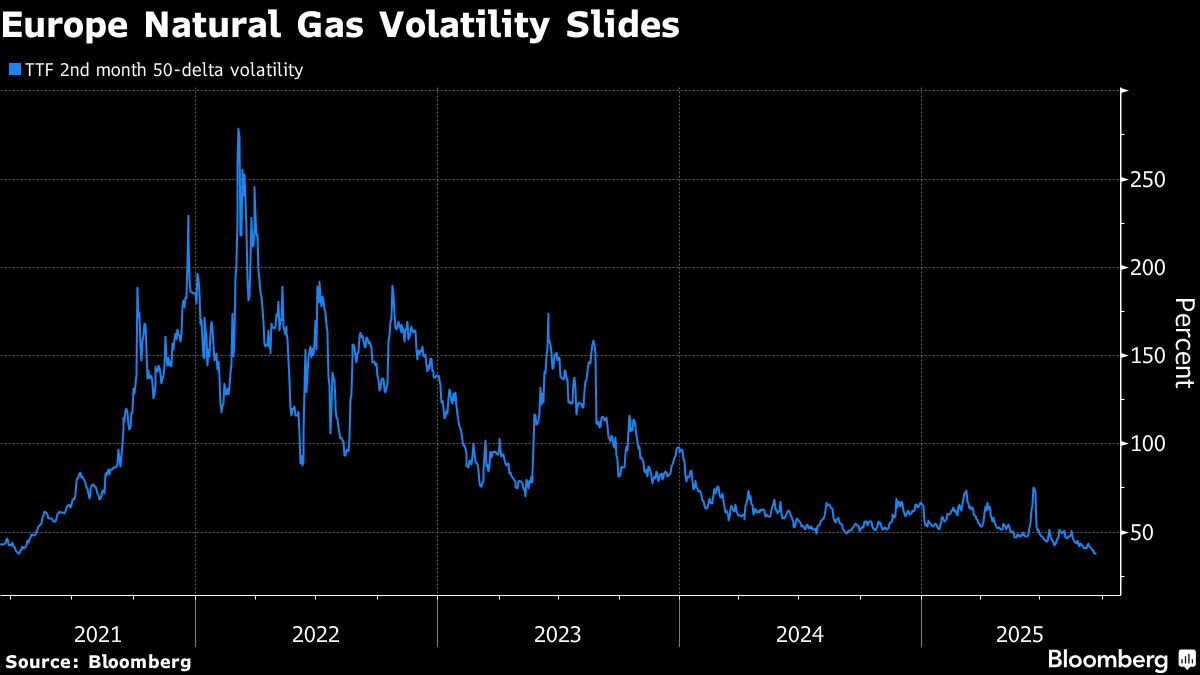

European gas traders are already placing bets on natural gas contracts, anticipating a price increase next summer. This early move suggests that some traders are hedging against potential price spikes, despite expectations of increased supplies coming online next year. Understanding these market dynamics is crucial as they can influence energy prices and availability for consumers.

— Curated by the World Pulse Now AI Editorial System